Dish Network 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–20

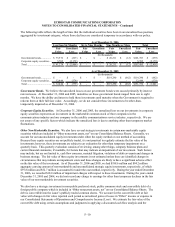

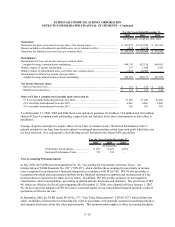

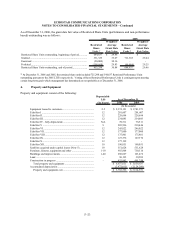

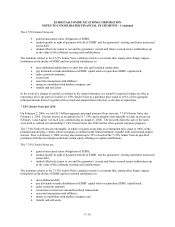

Total non-cash, stock-based compensation expense, net of related tax effect, as of December 31, 2006 was $11.0

million and was allocated to the same expense categories as the base compensation for key employees who

participate in our stock option plans, as follows:

For the Year Ended December 31,

2006 2005 2004

(In thousands)

Subscriber-related................................................. 549$ -$ 49$

Satellite and transmission...................................... 320 - 67

General and administrative................................... 10,149 190 1,023

Total non-cash, stock based compensation......... 11,018$ 190$ 1,139$

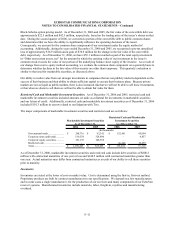

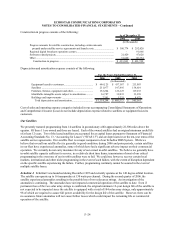

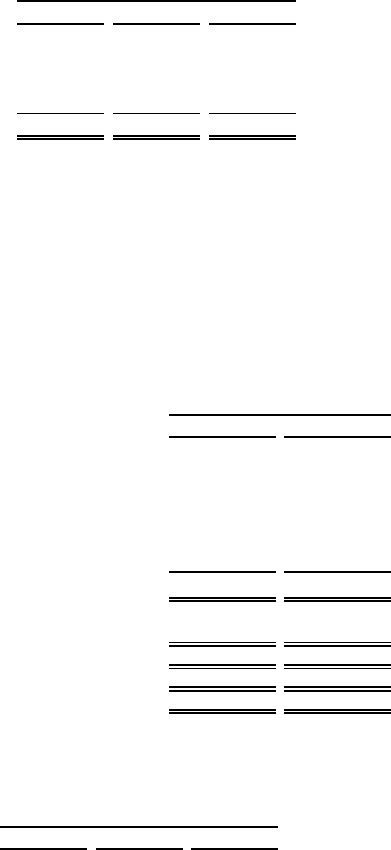

Prior to January 1, 2006, we applied the intrinsic value method of accounting under APB 25 and applied the

disclosure only provisions of SFAS 123. Pro forma information regarding net income and earnings per share was

required by SFAS 123 and has been determined as if we had accounted for our stock-based compensation plans

using the fair value method prescribed by that statement. For purposes of pro forma disclosures, the estimated fair

value of the options was amortized to expense over the options’ vesting period on a straight-line basis. We

accounted for forfeitures as they occurred. Compensation previously recognized was reversed in the event of

forfeitures of unvested options. The following table illustrates the effect on net income (loss) per share as if we had

accounted for our stock-based compensation plans using the fair value method under SFAS 123:

For the Years Ended

December 31,

2005 2004

(In thousands)

Net income (loss), as reported .................................................................................. $ 1,514,540 $ 214,769

Add: Stock-based employee compensation expense included

in reported net income (loss), net of related tax effect.................................... 190 1,139

Deduct: Total stock-based employee compensation expense determined

under fair value based method for all awards, net of related tax effect.......... (21,822) (20,515)

Pro forma net income (loss) ...................................................................................... $ 1,492,908 $ 195,393

Basic income (loss) per share, as reported ................................................................ $ 3.35 $ 0.46

Diluted income (loss) per share, as reported ............................................................. $ 3.22 $ 0.46

Pro forma basic income (loss) per share ................................................................... $ 3.30 $ 0.42

Pro forma diluted income (loss) per share ................................................................ $ 3.18 $ 0.42

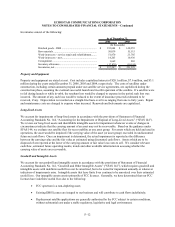

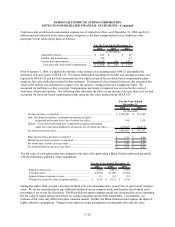

The fair value of each option grant was estimated at the date of the grant using a Black-Scholes option pricing model

with the following weighted-average assumptions:

For the Years Ended December 31,

2006 2005 2004

Risk-free interest rate ......................................................... 4.68% 4.09% 3.69%

Volatility factor .................................................................. 24.99% 26.10% 33.26%

Expected term of options in years....................................... 6.1 6.2 5.4

Weighted-average fair value of options granted ................ $ 11.58 $ 10.22 $ 11.66

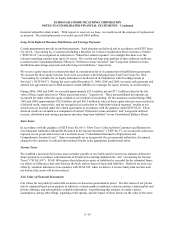

During December 2004, we paid a one-time dividend of $1 per outstanding share of our Class A and Class B common

stock. We do not currently plan to pay additional dividends on our common stock, and therefore the dividend yield

percentage is set at zero for all periods. The Black-Scholes option valuation model was developed for use in estimating

the fair value of traded options which have no vesting restrictions and are fully transferable. Consequently, our

estimate of fair value may differ from other valuation models. Further, the Black-Scholes model requires the input of

highly subjective assumptions. Changes in the subjective input assumptions can materially affect the fair value