Dish Network 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–27

been determined. There can be no assurance future anomalies will not cause further losses, which could further impact

commercial operation of the satellite or its useful life. See discussion of evaluation of impairment in “Long-Lived

Satellite Assets” below.

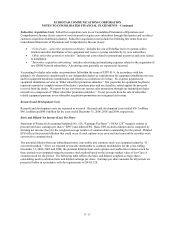

Long-Lived Satellite Assets. We account for impairments of long-lived satellite assets in accordance with the

provisions of Statement of Financial Accounting Standards No. 144, “Accounting for the Impairment or Disposal of

Long-Lived Assets” (“SFAS 144”). SFAS 144 requires a long-lived asset or asset group to be tested for

recoverability whenever events or changes in circumstance indicate that its carrying amount may not be recoverable.

Based on the guidance under SFAS 144, we evaluate our satellite fleet for recoverability as one asset group. While

certain of the anomalies discussed above, and previously disclosed, may be considered to represent a significant

adverse change in the physical condition of an individual satellite, based on the redundancy designed within each

satellite and considering the asset grouping, these anomalies (none of which caused a loss of service to subscribers

for an extended period) are not considered to be significant events that would require evaluation for impairment

recognition pursuant to the guidance under SFAS 144. Unless and until a specific satellite is abandoned or

otherwise determined to have no service potential, the net carrying amount related to the satellite would not be

written off.

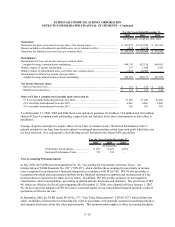

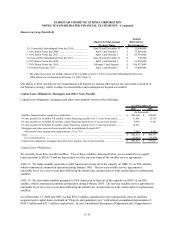

5. Long-Term Debt

5 3/4% Convertible Subordinated Notes due 2008

Effective February 15, 2007, we redeemed all of our outstanding 5 3/4% Convertible Subordinated Notes due 2008.

In accordance with the terms of the indenture governing the notes, the $1.0 billion principal amount of the notes was

redeemed at a redemption price of 101.643% of the principal amount, for a total of $1.016 billion. The premium

paid of $16.4 million, along with unamortized debt issuance costs of $3.6 million, were recorded as charges to

earnings in February 2007.

3% Convertible Subordinated Note due 2010

The 3% Convertible Subordinated Note, which was sold to AT&T in a privately negotiated transaction, matures July

21, 2010 and is convertible into approximately 6.87 million shares of our Class A common stock at the option of

AT&T at $72.82 per share, subject to adjustment in certain circumstances. Interest accrues at an annual rate of 3%

and is payable semi-annually in cash, in arrears on June 30 and December 31 of each year.

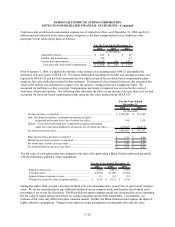

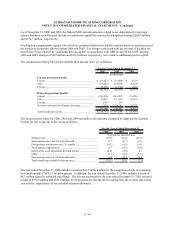

The 3% Convertible Subordinated Note due 2010 is:

• general unsecured obligations;

• ranked junior in right of payment with all of our existing and future senior debt;

• ranked equal in right of payment to our existing convertible subordinated debt; and

• ranked equal in right of payment to all other existing and future indebtedness whenever the instrument

expressly provides that such indebtedness ranks equal with the 3% Convertible Subordinated Note due

2010.

The indenture related to the 3% Convertible Subordinated Note due 2010 contains certain restrictive covenants that

do not impose material limitations on us.

In the event of a change of control, as defined in the related indenture, we would be required to make an offer to

repurchase all or any part of the holder’s 3% Convertible Subordinated Note due 2010 at a purchase price equal to

100% of the aggregate principal amount thereof, together with accrued and unpaid interest thereon, to the date of

repurchase. Commencing July 21, 2008, we may redeem, and AT&T may require us to purchase, all or a portion of

the note without premium.