Dish Network 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

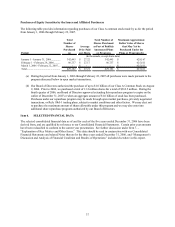

We are controlled by one principal stockholder.

Charles W. Ergen, our Chairman and Chief Executive Officer, currently beneficially owns approximately 49.1% of

our total equity securities and possesses approximately 76.8% of the total voting power. Thus, Mr. Ergen has the

ability to elect a majority of our directors and to control all other matters requiring the approval of our stockholders.

As a result of Mr. Ergen’s voting power, ECC is a “controlled company” as defined in the Nasdaq listing rules and

is, therefore, not subject to Nasdaq requirements that would otherwise require us to have (i) a majority of

independent directors; (ii) a nominating committee composed solely of independent directors; (iii) compensation of

our executive officers determined by a majority of the independent directors or a compensation committee

composed solely of independent directors; and (iv) director nominees selected, or recommended for the Board’s

selection, either by a majority of the independent directors or a nominating committee composed solely of

independent directors.

Our business depends substantially on FCC licenses that can expire or be revoked or modified and applications

that may not be granted.

If the FCC were to cancel, revoke, suspend or fail to renew any of our licenses or authorizations, it could have a

material adverse effect on our financial condition, profitability and cash flows. Specifically, loss of a frequency

authorization would reduce the amount of spectrum available to us, potentially reducing the amount of programming

and other services available to our subscribers. The materiality of such a loss of authorizations would vary based

upon, among other things, the location of the frequency used or the availability of replacement spectrum. In

addition, Congress often considers and enacts legislation that could affect us, and FCC proceedings to implement the

Communications Act and enforce its regulations are ongoing. We cannot predict the outcomes of these legislative

or regulatory proceedings or their effect on our business.

Our business relies on intellectual property, some of which is owned by third parties, and we may inadvertently

infringe their patents and proprietary rights.

Many entities, including some of our competitors, have or may in the future obtain patents and other intellectual

property rights that cover or affect products or services related to those that we offer. In general, if a court

determines that one or more of our products infringes on intellectual property held by others, we may be required to

cease developing or marketing those products, to obtain licenses from the holders of the intellectual property at a

material cost, or to redesign those products in such a way as to avoid infringing the patent claims. If those

intellectual property rights are held by a competitor, we may be unable to obtain the intellectual property at any

price, which could adversely affect our competitive position. Please see further discussion under Item 1. Business —

Patents and Trademarks of this Annual Report on Form 10-K.

We depend on other telecommunications providers, independent retailers and others to solicit orders for DISH

network services.

While we offer receiver systems and programming directly, a majority of our new subscriber acquisitions are

generated by independent businesses offering our products and services, including small satellite retailers, direct

marketing groups, local and regional consumer electronics stores, nationwide retailers, telecommunications

providers and others. If we are unable to continue our arrangements with these resellers, we cannot guarantee that

we would be able to obtain other sales agents, thus adversely affecting our business.

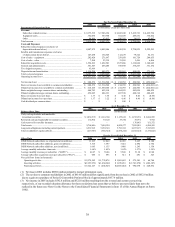

We have substantial debt outstanding and may incur additional debt.

As of December 31, 2006, our total debt, including the debt of our subsidiaries, was $6.967 billion. On February 15,

2007, we redeemed all of our outstanding 5 3/4% Convertible Subordinated Notes due 2008 which decreased our

total debt by $1.0 billion.