Dish Network 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

47

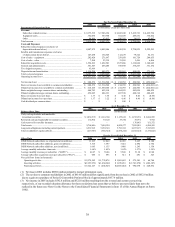

As previously discussed, our SAC calculation does not include the benefit of payments we received in connection

with equipment not returned to us from disconnecting lease subscribers and returned equipment that is made

available for sale rather than being redeployed through our lease program. During the years ended December 31,

2006 and 2005, these amounts totaled $120.5 million and $86.1 million, respectively.

Our “Subscriber acquisition costs,” both in aggregate and on a per new subscriber activation basis, may materially

increase in the future to the extent that we introduce more aggressive promotions if we determine that they are

necessary to respond to competition, or for other reasons. See further discussion under “Liquidity and Capital

Resources – Subscriber Retention and Acquisition Costs.”

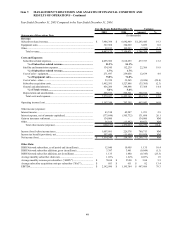

General and administrative expenses. “General and administrative expenses” totaled $551.5 million during the year

ended December 31, 2006, an increase of $95.3 million or 20.9% compared to 2005. This increase was primarily

attributable to increased personnel and related costs to support the growth of the DISH Network, including, among

other things, non-cash, stock-based compensation expense recorded related to the adoption of SFAS 123R, outside

professional fees and non-income based taxes. “General and administrative expenses” represented 5.6% and 5.4% of

“Total revenue” during the years ended December 31, 2006 and 2005, respectively. The increase in the ratio of those

expenses to “Total revenue” was primarily attributable to increased infrastructure expenses to support the growth of

the DISH Network, discussed above.

Tivo litigation expense. We recorded $94.0 million of “Tivo litigation expense” during the year ended December 31,

2006 as a result of the jury verdict in the Tivo lawsuit. Based on our current analysis of the case, including the

appellate record and other factors, we believe it is more likely than not that we will prevail on appeal.

Consequently, only the expense related to the original judgment has been accrued.

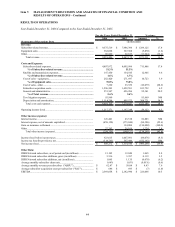

Depreciation and amortization. “Depreciation and amortization” expense totaled $1.114 billion during the year ended

December 31, 2006, an increase of $308.7 million or 38.3% compared to 2005. The increase in “Depreciation and

amortization” expense was primarily attributable to depreciation of equipment leased to subscribers resulting from

increased penetration of our equipment lease programs, additional depreciation related to satellites placed in service

and other depreciable assets placed in service to support the DISH Network.

Interest income. “Interest income” totaled $126.4 million during the year ended December 31, 2006, an increase of

$82.9 million compared to 2005. This increase principally resulted from higher cash and marketable investment

securities balances and higher total percentage returns earned on our cash and marketable investment securities during

2006.

Interest expense, net of amounts capitalized. “Interest expense” totaled $458.2 million during the year ended

December 31, 2006, an increase of $84.3 million or 22.6% compared to 2005. This increase primarily resulted from a

net increase in interest expense of $65.1 million related to the issuance of additional senior debt during 2006, net of

redemptions, and an increase in prepayment premiums and write-off of debt issuance costs totaling $28.7 million,

related to the redemption of certain outstanding senior debt during 2006. This increase was partially offset by an

increase in capitalized interest on construction of satellites.

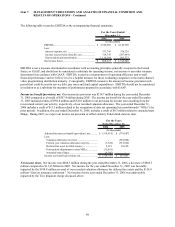

Earnings before interest, taxes, depreciation and amortization. EBITDA was $2.369 billion during the year ended

December 31, 2006, an increase of $226.0 million or 10.5% compared to 2005. EBITDA for the year ended

December 31, 2005 was favorably impacted by the $134.0 million “Gain on insurance settlement” and the year

ended December 31, 2006 was negatively impacted by the $94.0 million “Tivo litigation expense.” Absent these

items, our EBITDA for the year ended December 31, 2006 would have been $454.0 million or 22.6% higher than

EBITDA in 2005. The increase in EBITDA (excluding these items) was primarily attributable to changes in operating

revenues and expenses discussed above.