Dish Network 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–15

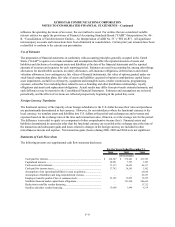

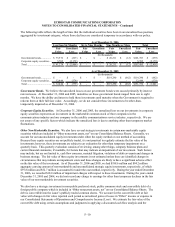

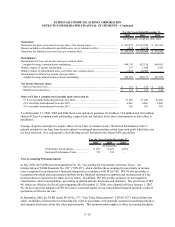

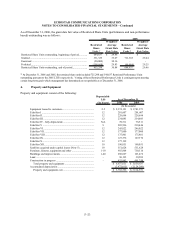

The following table summarizes the book and fair values of our debt facilities at December 31, 2006 and 2005:

As of December 31, 2006 As of December 31, 2005

Book Value Fair Value Book Value Fair Value

(In thousands)

5 3/4% Convertible Subordinated Notes due 2008 (1)........ $ - $ - $ 1,000,000 $ 973,750

9 1/8% Senior Notes due 2009 (2)....................................... - - 441,964 462,405

3% Convertible Subordinated Note due 2010 ..................... 500,000 472,400 500,000 451,500

Floating Rate Senior Notes due 2008 (2)............................. - - 500,000 510,000

5 3/4% Senior Notes due 2008............................................. 1,000,000 993,750 1,000,000 980,000

6 3/8% Senior Notes due 2011............................................. 1,000,000 993,750 1,000,000 968,650

3% Convertible Subordinated Note due 2011...................... 25,000 22,780 25,000 21,725

6 5/8% Senior Notes due 2014............................................. 1,000,000 971,250 1,000,000 958,750

7 1/8% Senior Notes due 2016............................................. 1,500,000 1,494,375 - -

7 % Senior Notes due 2013.................................................. 500,000 497,500 - -

Mortgages and other notes payable ..................................... 37,379 37,379 30,275 30,275

Subtotal................................................................................ $ 5,562,379 $ 5,483,184 $ 5,497,239 $ 5,357,055

Capital lease obligations (3)................................................. 404,942 N/A 438,062 N/A

Total..................................................................................... 5,967,321$ 5,483,184$ 5,935,301$ 5,357,055$

(1) The 5 3/4% Convertible Subordinated Notes due 2008 were redeemed on February 15, 2007 (see Note 5).

(2) The 9 1/8% Senior Notes due 2009 and the Floating Rate Senior Notes due 2008 were redeemed on February 17, 2006 and

October 2, 2006, respectively.

(3) Pursuant to SFAS No. 107 “Disclosures about Fair Value of Financial Instruments,” disclosures regarding fair value of

capital leases is not required.

As of December 31, 2006 and 2005, the book value approximates fair value for cash and cash equivalents, trade

accounts receivable, net of allowance for doubtful accounts, and current liabilities due to their short-term nature. Also,

the book value is equal to fair value for marketable securities as of December 31, 2006 and 2005.

Deferred Debt Issuance Costs

Costs of issuing debt are generally deferred and amortized to interest expense over the terms of the respective notes

(Note 5).

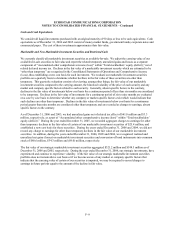

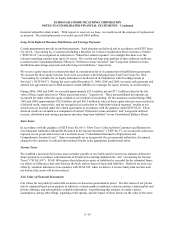

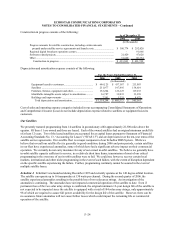

Revenue Recognition

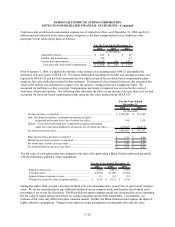

We recognize revenue when an arrangement exists, prices are determinable, collectibility is reasonably assured and

the goods or services have been delivered. Revenue from our subscription television services is recognized when

programming is broadcast to subscribers. Programming payments received from subscribers in advance of the

broadcast or service period are recorded as “Deferred revenue” in the Consolidated Balance Sheets until earned. For

certain of our promotions relating to EchoStar receiver systems, subscribers are charged an upfront fee. A portion of

this fee may be deferred and recognized over 48 to 60 months, depending on whether the fee is received from existing

or new subscribers. Revenue from advertising sales is recognized when the related services are performed.

Subscriber fees for receivers with multiple tuners, high definition (“HD”) receivers, digital video recorders

(“DVRs”), and HD DVRs, our DishHOME Protection Plan and other services are recognized as revenue, monthly as

earned. Revenue from equipment sales is recognized upon shipment to customers.

Revenue from equipment sales to AT&T pursuant to our original agreement with AT&T is deferred and recognized

over the estimated average co-branded subscriber life. Revenue from installation and certain other services

performed at the request of AT&T is recognized upon completion of the services. Further, development and

implementation fees received from AT&T will continue to be recognized over the estimated average subscriber life

of all subscribers acquired under both the original and revised agreements with AT&T.