Dish Network 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

55

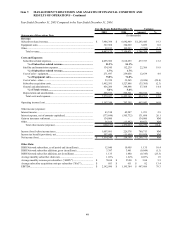

assets and liabilities. The increase in “Purchases of property and equipment” was primarily attributable to increased

spending for equipment under our new and existing lease programs, and satellite construction, partially offset by a

decline in overall corporate capital expenditures.

Our future capital expenditures could increase or decrease depending on the strength of the economy, strategic

opportunities or other factors.

Cash flows from operating activities. We typically reinvest the cash flow from operating activities in our business

primarily to grow our subscriber base and to expand our infrastructure. For the years ended December 31, 2006,

2005 and 2004, we reported net cash flows from operating activities of $2.279 billion, $1.774 billion, and $1.001

billion, respectively. See discussion of changes in net cash flows from operating activities included in “Free cash

flow” above.

Cash flows from investing activities. Our investing activities generally include purchases and sales of marketable

investment securities and cash used to grow our subscriber base and expand our infrastructure. For the years ended

December 31, 2006 and 2005, we reported net cash outflows from investing activities of $1.994 billion and $1.460

billion. For the year ended December 31, 2004, we reported net cash inflows from investing activities of $1.078

billion.

The decrease in cash flow from investing activities from 2005 to 2006 of $533.6 million primarily resulted from an

increase in net purchases of marketable investment securities; partially offset by a decrease in cash used for capital

expenditures during 2006. Cash flow from investing activities for 2005 was favorably impacted by a $240.0 million

insurance settlement.

The decrease from 2004 to 2005 of $2.538 billion primarily resulted from a decrease in net sales of marketable

investment securities and an increase in cash used for capital expenditures during 2005. The decrease in net cash flows

from investing activities was partially offset by an increase in cash due to the insurance settlement of $240.0 million

previously disclosed and the decrease in asset acquisitions during 2005.

Cash flows from financing activities. Our financing activities include net proceeds related to the issuance of long-term

debt, and cash used for the repurchase or redemption of long-term debt, and capital lease obligations, mortgages or

other notes payable, repurchases of our Class A common stock and dividends. For the year ended December 31, 2006,

we reported net cash inflows from financing activities of $1.022 billion. For the years ended December 31, 2005 and

2004, we reported net cash outflows from financing activities of $402.6 million and $2.666 billion, respectively.

The improvement from 2005 to 2006 of $1.425 billion principally resulted from the following:

• On February 2, 2006, we sold $1.5 billion principal amount of our 7 1/8% Senior Notes due 2016.

• On October 18, 2006, we sold $500.0 million principal amount of our 7% Senior Notes due 2013.

• On February 17, 2006, we redeemed the remaining $442.0 million outstanding principal amount of our

9 1/8% Senior Notes due 2009.

• On October 1, 2006, we redeemed the $500.0 million outstanding principal amount of our Rate Senior Notes

due 2008.

• During 2006, we repurchased approximately 429,000 shares of our Class A common stock in open market

transactions for a total cost of $11.7 million compared to approximately 13.2 million shares at a total cost of

$362.5 million during 2005.

The improvement from 2004 to 2005 of $2.263 billion principally resulted from the following:

• During 2004, we redeemed the remaining $1.423 billion outstanding principal amount of our 9 3/8% Senior

Notes due 2009 and our $1.0 billion outstanding principal amount of the 10 3/8% Senior Notes due 2007.

• During 2004, we paid a cash dividend of $455.7 million to holders of our Class A and Class B common stock.

• During 2005, we repurchased approximately 13.2 million shares of our Class A common stock in open market

transactions for a total cost of $362.5 million compared to approximately 25.9 million shares at a total cost of

$809.6 million during 2004.