Costco 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 7—Income Taxes (Continued)

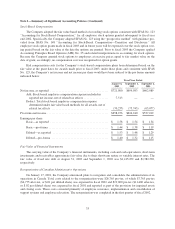

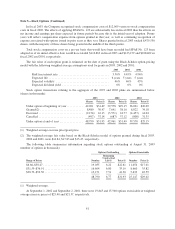

Reconciliation between the statutory tax rate and the effective rate for fiscal 2003, 2002 and 2001 is as fol-

lows:

2003 2002 2001

Federal taxes at statutory rate ................. $405,382 35.00% $398,364 35.00% $351,218 35.00%

State taxes, net ............................. 37,875 3.27 34,145 3.00 35,824 3.57

Foreign taxes, net .......................... (396) (0.03) 2,732 0.24 10,938 1.09

Other .................................... (5,628) (0.49) 2,960 0.26 3,412 0.34

Provision at effective tax rate ................. $437,233 37.75% $438,201 38.50% $401,392 40.00%

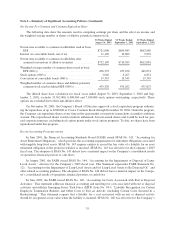

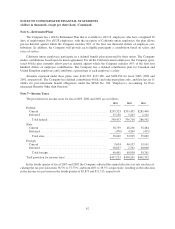

The components of the deferred tax assets and liabilities are as follows:

August 31,

2003

September 1,

2002

Accrued liabilities and reserves ..................................... $168,683 $151,520

Deferred membership fees ......................................... 141,005 137,231

Other .......................................................... 28,465 30,271

Total deferred tax assets ......................................... 338,153 319,022

Property and equipment ........................................... 210,822 175,344

Merchandise inventories .......................................... 64,701 51,951

Other receivables ................................................ 91,126 46,686

Total deferred tax liabilities ...................................... 366,649 273,981

Net deferred tax (liabilities) assets ................................... $(28,496) $ 45,041

The deferred tax accounts at August 31, 2003 and September 1, 2002 include current deferred income tax

assets of $213,939 and $173,602, respectively; non-current deferred income tax assets of $14,316 and $0, re-

spectively; current deferred income tax liabilities of $74,002 and $0, respectively; and non-current deferred in-

come tax liabilities of $182,749 and $128,561, respectively.

The Company has not provided for U.S. deferred taxes on cumulative undistributed earnings of non-U.S.

affiliates aggregating approximately $622,017 at August 31, 2003, as such earnings have been reinvested for the

foreseeable future. Because of the availability of U.S. foreign tax credits, it is not practicable to determine the

U.S. federal income tax liability or benefit associated with such earnings if such earnings were not reinvested for

the foreseeable future.

Note 8—Commitments and Contingencies

Legal Proceedings

The Company is involved from time to time in claims, proceedings and litigation arising from its business

and property ownership. The Company is a defendant in two actions purportedly brought as class actions on be-

half of certain present and former Costco managers in California, in which plaintiffs allege that they have not

been properly compensated for overtime work. Presently, claims are made under various provisions of the Cal-

ifornia Labor Code and the California Business and Professions Code. Plaintiffs seek restitution/disgorgement,

compensatory damages, various statutory penalties, liquidated damages, punitive, treble and exemplary damages,

and attorneys’ fees. In neither case has the Court been asked yet to determine whether the action should proceed

as a class action or, if so, the definition of the class. The Company expects to vigorously defend these actions.

The Company does not believe that any claim, proceeding or litigation, either alone or in the aggregate, will have

a material adverse effect on the company’s financial position or results of its operations.

43