Costco 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.entered into effective November 13, 2001, and March 25, 2002, and are designated and qualify as fair value

hedges of the Company’s $300,000 7

1

⁄

8

% Senior Notes and the Company’s $300,000 5

1

⁄

2

%Senior Notes, re-

spectively. As the terms of the swaps match those of the underlying hedged debt, the changes in the fair value of

these swaps are offset by corresponding changes in the carrying amount of the hedged debt, and result in no net

earnings impact.

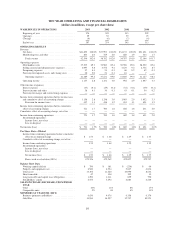

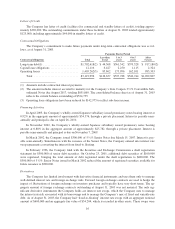

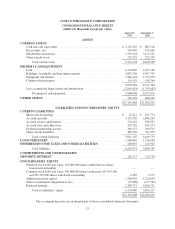

Financial Position and Cash Flows

Working capital totaled $700,431 at August 31, 2003, compared to $180,806 at September 1, 2002. The in-

crease of $519,625 was primarily due to an increase in cash and cash equivalents of $739,921, an increase in re-

ceivables of $81,229 and a reduction in short-term borrowing of $56,353, which was offset by increases in

accrued salaries and benefits and in other current liabilities of $144,334 and $141,381, respectively, and a de-

crease in net inventory levels (inventories less accounts payable) of $34,844.

Net cash provided by operating activities totaled $1,507,208 in fiscal 2003, compared to $1,018,243 in fiscal

2002. The increase of $488,965 is primarily a result of a decrease in the change in net inventories (inventories

less accounts payable) of $256,288; an increase in the change in the aggregation of receivables, other current as-

sets, deferred income and accrued and other current liabilities of $102,284, an increase in the change in deferred

income taxes of $56,514 and an increase in depreciation and amortization of $49,521 between fiscal 2003 and

fiscal 2002.

Net cash used in investing activities totaled $790,588 in fiscal 2003, compared to $1,033,815 in fiscal 2002,

a decrease of $243,227. This decrease is primarily a result of a reduction in the acquisition of property and

equipment and the construction of facilities for new and remodeled warehouses of $227,940 and an increase in

the proceeds received from the sale of property and equipment between fiscal 2003 and fiscal 2002 of $18,980.

Net cash used in financing activities totaled $1,428 in fiscal 2003 compared to cash provided by financing

activities of $217,828 in fiscal 2002, a decrease of $219,256. The decrease in cash provided by financing activ-

ities primarily resulted from a decrease in net proceeds from the issuance of long-term debt of $240,576 and a

reduction in proceeds from the exercise of stock options of $32,104 offset by a decrease in repayments of short-

term borrowings of $41,031 between fiscal 2003 and fiscal 2002.

Stock Repurchase Program

On November 30, 2001, the Company’s Board of Directors approved a stock repurchase program, authoriz-

ing the repurchase of up to $500,000 of Costco Common Stock through November 30, 2004. Under the program,

the Company can repurchase shares at any time in the open market or in private transactions as market conditions

warrant. The repurchased shares would constitute authorized, but non-issued shares and would be used for gen-

eral corporate purposes, including stock option grants under stock option programs. To date, no shares have been

repurchased under this program.

Additional Equity Investments in Subsidiary Subsequent to Year-End

Subsequent to the Company’s fiscal year end, the Company, on October 3, 2003 acquired from Carrefour

Nederland B.V. its 20% equity interest in Costco Wholesale UK Limited for cash of approximately $95,000,

bringing Costco’s ownership in Costco Wholesale UK Limited to 100%.

Critical Accounting Policies

The preparation of the Company’s financial statements requires that management make estimates and judg-

ments that affect the financial position and results of operations. Management continues to review its accounting

policies and evaluate its estimates, including those related to merchandise inventory, impairment of long-lived

assets and warehouse closing costs and insurance/self-insurance liabilities. The Company bases its estimates on

historical experience and on other assumptions that management believes to be reasonable under the present cir-

cumstances.

17