Costco 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.compared to 35 new warehouses (including 6 relocations) during fiscal 2002. Pre-opening expenses also include

costs related to remodels and expanded ancillary operations at existing warehouses, as well as expanded interna-

tional operations.

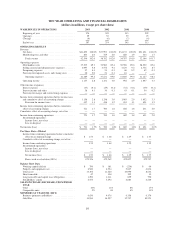

The provision for impaired assets and closing costs was $19,500 in fiscal 2003 compared to $21,050 in fis-

cal 2002. The provision includes costs related to impairment of long-lived assets, future lease obligations of

warehouses that have been relocated to new facilities and any losses or gains resulting from the sale of real prop-

erty. The provision for fiscal 2003 included charges of $11,836 for warehouse closing expenses, $4,697 for im-

pairment of long-lived assets and $2,967 for net losses on the sale of real property. The fiscal 2002 provision

included charges of $13,683 for warehouse closing expenses and $7,765 for Canadian administrative reorganiza-

tion, which were offset by $398 of net gains on the sale of real property. At August 31, 2003 the reserve for

warehouse closing costs was $8,609, of which $7,833 related to lease obligations. This compares to a reserve for

warehouse closing costs of $11,845 at September 1, 2002, of which $10,395 related to lease obligations.

Interest expense totaled $36,920 in fiscal 2003, and $29,096 in fiscal 2002. Interest expense in fiscal 2003

includes interest on the 3

1

⁄

2

% Zero Coupon Notes, 7

1

⁄

8

% and 5

1

⁄

2

% Senior Notes and on balances outstanding

under the Company’s bank credit facilities and promissory notes. The increase is primarily related to the reduc-

tion in interest capitalized related to warehouse construction, as the overall cost of projects under construction

was lower than in fiscal 2002. The increase was also attributed to the Company’s issuance of $300,000 5

1

⁄

2

%

Senior Notes in March 2002, which were simultaneously swapped to a floating interest rate. This increase was

partially offset by an interest rate reduction in the Company’s $300,000 7

1

⁄

8

% Senior Notes, resulting from

interest rate swap agreements entered into effective November 13, 2001, converting the interest rate from fixed to

floating, and to the fact that the Company had little interest expense related to borrowings under its commercial

paper program in fiscal 2003.

Interest income and other totaled $38,525 in fiscal 2003, compared to $35,745 in fiscal 2002. The increase

primarily reflects greater interest earned on higher cash and cash equivalents balances on hand throughout fiscal

2003, as compared to fiscal 2002, which was partially offset by an increase in the expense to record the minority

interest in earnings of foreign subsidiaries.

The effective income tax rate on earnings was 37.75% in fiscal 2003 and 38.50% in fiscal 2002. The de-

crease in the effective income tax rate, year-over-year, is primarily attributable to lower statutory income tax

rates for foreign operations.

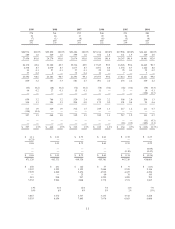

Comparison of Fiscal 2002 (52 weeks) and Fiscal 2001 (52 weeks):

(dollars in thousands, except earnings per share)

Net income for fiscal 2002 increased 16% to $699,983, or $1.48 per diluted share, from $602,089, or $1.29

per diluted share during fiscal year 2001.

Net sales increased 11% to $37,993,093 in fiscal 2002 from $34,137,021 in fiscal 2001. This increase was

due to higher sales at existing locations opened prior to fiscal 2001; increased sales at the 32 new warehouses

opened (39 opened, 7 closed) during fiscal 2001; and first year sales at the 29 new warehouses opened (35

opened, 6 closed) during fiscal 2002. Changes in prices did not materially impact sales levels.

Comparable sales, that is sales in warehouses open for at least a year, increased at a 6% annual rate in fiscal

2002 compared to a 4% annual rate during fiscal 2001.

Membership fees and other revenue increased 17% to $769,406, or 2.03% of net sales, in fiscal 2002 from

$660,016, or 1.93% of net sales, in fiscal 2001. This increase was primarily due to the increase in membership

fees across all member categories – beginning with renewals on October 1, 2000, averaging approximately five

dollars per member; additional membership sign-ups at the 29 new warehouses opened in fiscal 2002; and in-

creased penetration of the Company’s Executive Membership. Overall, member renewal rates remained con-

sistent with the prior year, currently at 86%.

Gross margin (defined as net sales minus merchandise costs) increased 13% to $4,009,972, or 10.55% of net

sales, in fiscal 2002 from $3,538,881, or 10.37% of net sales, in fiscal 2001. The increase in gross margin as a

13