Costco 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

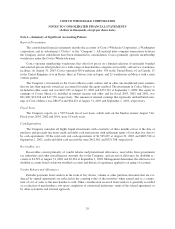

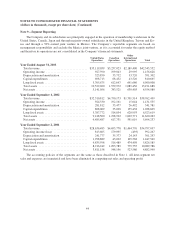

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data) (Continued)

Note 1—Summary of Significant Accounting Policies (Continued)

Closing Costs

Warehouse closing costs incurred relate principally to the Company’s efforts to relocate certain warehouses

that were not otherwise impaired to larger and better-located facilities. The provision for fiscal 2003 included

charges of $11,836 for warehouse closing expenses and $2,967 for losses on the sale of real property. The fiscal

2002 provision included charges of $13,683 for warehouse closing expenses and $7,765 for Canadian admin-

istrative reorganization, which were offset by $398 of net gains on the sale of real property. As of August 31,

2003, the Company’s reserve for warehouse closing costs was $8,609, of which $7,833 related to lease obliga-

tions. This compares to a reserve for warehouse closing costs of $11,845 at September 1, 2002, of which $10,395

related to lease obligations.

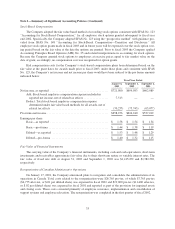

Interest Income and Other

Interest income and other includes:

Fiscal Year Ended

August 31,

2003

September 1,

2002

September 2,

2001

Interest income ....................................... $21,200 $16,005 $25,908

Minority interest/earnings of affiliates and other ............. 17,325 19,740 17,330

Total ........................................... $38,525 $35,745 $43,238

Income Taxes

The Company accounts for income taxes under the provisions of SFAS No. 109, “Accounting for Income

Taxes.” That standard requires companies to account for deferred income taxes using the asset and liability

method.

Under the asset and liability method of SFAS No. 109, deferred tax assets and liabilities are recognized for

the future tax consequences attributed to differences between the financial statement carrying amounts of existing

assets and liabilities and their respective tax bases and tax credits and loss carry-forwards. Deferred tax assets

and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which

those temporary differences and carry-forwards are expected to be recovered or settled. The effect on deferred

tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment

date. A valuation allowance is established when necessary to reduce deferred tax assets to amounts expected to

be realized.

34