Costco 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data) (Continued)

Note 1—Summary of Significant Accounting Policies (Continued)

Revenue Recognition

The Company recognizes sales, net of estimated returns, at the time the member takes possession of mer-

chandise or receives services. When the Company collects payment from customers prior to the transfer of

ownership of merchandise or the performance of services, the amount received is recorded as deferred revenue.

The Company provides for estimated sales returns based on historical returns levels. The reserve for sales returns

(sales returns net of cost of goods sold) was $4,869 and $3,507 at August 31, 2003 and September 1, 2002, re-

spectively.

Membership fee revenue represents annual membership fees paid by substantially all of the Company’s

members. The Company accounts for membership fee revenue on a “deferred basis,” whereby membership fee

revenue is recognized ratably over the one-year life of the membership. The Company’s Executive members

qualify for a 2% reward (which can be redeemed at Costco warehouses), up to a maximum of $500 per year, on

all qualified purchases made at Costco. The Company accounts for this 2% reward as a reduction in sales, with

the related liability being classified within other current liabilities. The sales reduction and corresponding li-

ability are computed after giving effect to the estimated impact of non-redemptions based on historical data. The

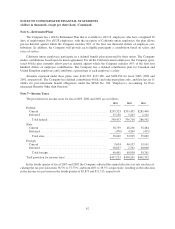

reduction in sales for the fiscal years ended August 31, 2003, September 1, 2002 and September 2, 2001, and the

related liability as of those dates were as follows:

Fiscal Year Ended

August 31,

2003

September 1,

2002

September 2,

2001

Two-percent reward sales reduction ....................... $169,612 $143,637 $84,243

Two-percent unredeemed reward liability .................. $114,681 $ 94,448 $57,840

Merchandise Costs

Merchandise costs consist of the purchase price of inventory sold, inbound shipping charges and all costs

related to our depot operations, including freight from depots to selling warehouses. Merchandise costs also in-

clude salaries, benefits, depreciation on production equipment, and other related expenses incurred in certain

fresh foods and ancillary departments.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist primarily of salaries, benefits and workers’ compensa-

tion costs for warehouse employees, other than fresh foods and certain ancillary businesses, as well as all

regional and home office employees, including buying personnel. Selling, general and administrative expenses

also include utilities, bank charges and substantially all building and equipment depreciation, as well as other

operating costs incurred to support warehouse operations.

Marketing and Promotional Expenses

Costco’s policy is generally to limit marketing and promotional expenses to new warehouse openings, occa-

sional direct mail marketing to prospective new members and annual direct mail marketing programs to existing

members promoting selected merchandise. Marketing and promotional costs are expensed as incurred.

Preopening Expenses

Preopening expenses related to new warehouses, major remodels/expansions, regional offices and other

startup operations are expensed as incurred.

32