Costco 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

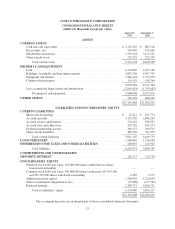

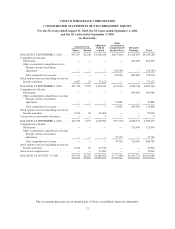

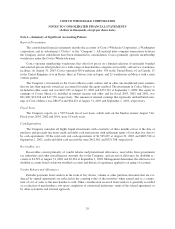

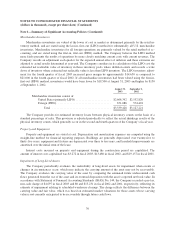

Note 1—Summary of Significant Accounting Policies (Continued)

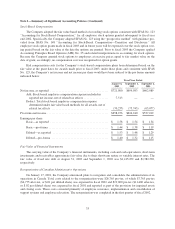

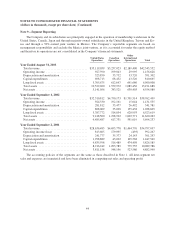

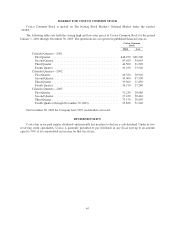

Net Income Per Common and Common Equivalent Share

The following data show the amounts used in computing earnings per share and the effect on income and

the weighted average number of shares of dilutive potential common stock.

52 Weeks Ended

August 31, 2003

52 Weeks Ended

September 1, 2002

52 Weeks Ended

September 2, 2001

Net income available to common stockholders used in basic

EPS ........................................... $721,000 $699,983 $602,089

Interest on convertible bonds, net of tax ................ 11,109 10,602 9,992

Net income available to common stockholders after

assumed conversions of dilutive securities ............ $732,109 $710,585 $612,081

Weighted average number of common shares used in basic

EPS (000’s) .................................... 456,335 453,650 449,631

Stock options (000’s) ............................... 3,646 6,267 6,851

Conversion of convertible bonds (000’s) ................ 19,345 19,345 19,345

Weighted number of common shares and dilutive potential

common stock used in diluted EPS (000’s) ............ 479,326 479,262 475,827

The diluted share base calculation for fiscal years ended August 31, 2003, September 1, 2002 and Sep-

tember 2, 2001, excludes 33,362,000, 6,908,000 and 7,108,000 stock options outstanding, respectively. These

options are excluded due to their anti-dilutive effect.

On November 30, 2001, the Company’s Board of Directors approved a stock repurchase program authoriz-

ing the repurchase of up to $500,000 of Costco Common Stock through November 30, 2004. Under the program,

the Company can repurchase shares at any time in the open market or in private transactions as market conditions

warrant. The repurchased shares would constitute authorized, but non-issued shares and would be used for gen-

eral corporate purposes, including stock option grants under stock option programs. To date, no shares have been

repurchased under this program.

Recent Accounting Pronouncements

In June 2001, the Financial Accounting Standards Board (FASB) issued SFAS No. 143, “Accounting for

Asset Retirement Obligations,” which provides the accounting requirements for retirement obligations associated

with tangible long-lived assets. SFAS No. 143 requires entities to record the fair value of a liability for an asset

retirement obligation in the period in which it is incurred. SFAS No. 143 was effective for the Company’s 2003

fiscal year. The adoption of SFAS No. 143 did not have a material impact on the Company’s consolidated results

of operations, financial position or cash flows.

In August 2001, the FASB issued SFAS No. 144, “Accounting for the Impairment or Disposal of Long-

Lived Assets,” effective for the Company’s 2003 fiscal year. This Statement supersedes FASB Statement No.

121, “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed Of,” and

other related accounting guidance. The adoption of SFAS No. 144 did not have a material impact on the Compa-

ny’s consolidated results of operations, financial position, or cash flows.

In June 2002, the FASB issued SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal

Activities.” This statement addresses financial accounting and reporting for costs associated with exit or disposal

activities and nullifies Emerging Issues Task Force (EITF) Issue No. 94-3, “Liability Recognition for Certain

Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred in a

Restructuring).” This statement requires that a liability for a cost associated with an exit or disposal activity

should be recognized at fair value when the liability is incurred. SFAS No. 146 was effective for the Company’s

35