Costco 2003 Annual Report Download - page 17

Download and view the complete annual report

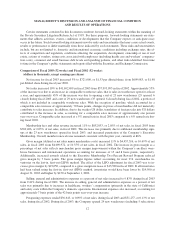

Please find page 17 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity and Capital Resources (dollars in thousands)

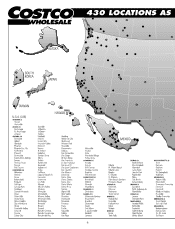

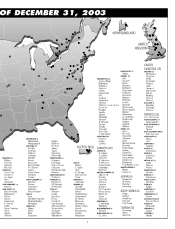

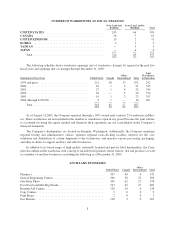

Expansion Plans

Costco’s primary requirement for capital is the financing of the land, building and equipment costs for new

warehouses plus the costs of initial warehouse operations and working capital requirements, as well as additional

capital for international expansion through investments in foreign subsidiaries and joint ventures.

While there can be no assurance that current expectations will be realized, and plans are subject to change

upon further review, it is management’s current intention to spend an aggregate of approximately $900,000 to

$1,000,000 during fiscal 2004 in the United States and Canada for real estate, construction, remodeling and

equipment for warehouse clubs and related operations; and approximately $75,000 to $125,000 for international

expansion, including the United Kingdom, Asia, Mexico and other potential ventures. These expenditures will be

financed with a combination of cash provided from operations, the use of cash and cash equivalents and short-

term investments, short-term borrowings under the Company’s commercial paper program and other financing

sources as required.

Expansion plans for the United States and Canada during fiscal 2004 are to open approximately 25 new

warehouse clubs, including two relocations to larger and better-located warehouses. The Company expects to

continue its review of expansion plans in its international operations in existing markets including the United

Kingdom and in Asia along with other international markets. Costco and its Mexico-based joint venture partner,

Controladora Comercial Mexicana, each own a 50% interest in Costco Mexico. As of August 31, 2003, Costco

Mexico operated 21 warehouses in Mexico and planned to open two new warehouse clubs during fiscal 2004.

Reorganization of Canadian Administrative Operations

On January 17, 2001, the Company announced plans to reorganize and consolidate the administration of its

operations in Canada. Total costs related to the reorganization were $26,765 pre-tax, of which $7,765 pre-tax

($4,775 after-tax, or $.01 per diluted share) was expensed in fiscal 2002 and $19,000 pre-tax ($11,400 after-tax,

or $.02 per diluted share) was expensed in fiscal 2001 and reported as part of the provision for impaired assets

and closing costs. These costs consisted primarily of employee severance, implementation and consolidation of

support systems and employee relocation. The reorganization was completed in the first quarter of fiscal 2002.

Bank Credit Facilities and Commercial Paper Programs (all amounts stated in thousands of US dollars)

The Company has in place a $500,000 commercial paper program supported by a $300,000 bank credit fa-

cility with a group of ten banks, of which $150,000 expires on November 9, 2004 and $150,000 expires on No-

vember 15, 2005. At August 31, 2003, no amounts were outstanding under the commercial paper program and no

amounts were outstanding under the credit facility.

A wholly owned Canadian subsidiary has a $144,000 commercial paper program supported by a $43,000

bank credit facility with a Canadian bank, which expires in March 2004. At August 31, 2003, no amounts were

outstanding under the Canadian commercial paper program or the bank credit facility.

The Company has agreed to limit the combined amount outstanding under the U.S. and Canadian commer-

cial paper programs to the $343,000 combined amounts of the supporting bank credit facilities.

The Company’s wholly-owned Japanese subsidiary has a short-term ¥3 billion ($25,782) bank line of credit,

which expires in November 2004. At August 31, 2003, no amounts were outstanding under the line of credit.

The Company’s UK subsidiary has a £60 million ($94,842) bank revolving credit facility and a £20 million

($31,614) bank overdraft facility, both expiring in February 2007. At August 31, 2003, $47,421 was outstanding

under the revolving credit facility with an applicable interest rate of 4.413% and no amounts were outstanding

under the bank overdraft facility.

15