Costco 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

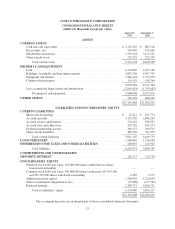

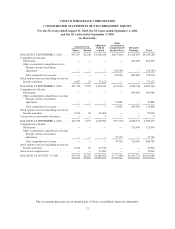

COSTCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in thousands)

52 Weeks

Ended

August 31,

2003

52 Weeks

Ended

September 1,

2002

52 Weeks

Ended

September 2,

2001

CASH FLOWS FROM OPERATING ACTIVITIES

Net income ............................................. $ 721,000 $ 699,983 $ 602,089

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization ............................ 391,302 341,781 301,297

Accretion of discount on zero coupon notes ................. 17,852 17,233 16,654

Stock-based compensation ............................... 12,069 — —

Undistributed equity earnings in affiliates ................... (21,612) (21,485) (17,719)

Net loss/(gain) on sale of property and equipment and other ..... 4,907 4,001 (15,934)

Provision for impaired assets ............................. 4,697 — 15,231

Change in deferred income taxes .......................... 68,693 12,179 40,797

Tax benefit from exercise of stock options .................. 12,348 27,171 32,552

Change in receivables, other current assets, deferred income,

accrued and other current liabilities ...................... 232,167 129,883 (6,159)

Increase in merchandise inventories ........................ (162,759) (380,158) (271,355)

Increase in accounts payable ............................. 226,544 187,655 335,110

Total adjustments .................................... 786,208 318,260 430,474

Net cash provided by operating activities ................... 1,507,208 1,018,243 1,032,563

CASH FLOWS FROM INVESTING ACTIVITIES

Additions to property and equipment ......................... (810,665) (1,038,605) (1,447,549)

Proceeds from the sale of property and equipment .............. 51,829 32,849 110,002

Investment in unconsolidated joint venture .................... — (1,000) (28,500)

Decrease in short-term investments .......................... — 4,928 41,599

Increase in other assets and other, net ........................ (31,752) (31,987) (15,395)

Net cash used in investing activities ........................ (790,588) (1,033,815) (1,339,843)

CASH FLOWS FROM FINANCING ACTIVITIES

(Repayments)/proceeds from short-term borrowings, net ......... (58,144) (99,175) 185,942

Net proceeds from issuance of long-term debt .................. 59,424 300,000 81,951

Repayments of long-term debt .............................. (11,823) (18,540) (159,328)

Changes in bank checks outstanding ......................... (31,639) (35,136) 216,661

Proceeds from minority interests ............................ 6,087 3,908 7,119

Exercise of stock options .................................. 34,667 66,771 62,000

Net cash (used in)/provided by financing activities ............ (1,428) 217,828 394,345

EFFECT OF EXCHANGE RATE CHANGES ON CASH ....... 24,729 677 (8,985)

Increase in cash and cash equivalents ........................ 739,921 202,933 78,080

CASH AND CASH EQUIVALENTS BEGINNING OF YEAR ... 805,518 602,585 524,505

CASH AND CASH EQUIVALENTS END OF YEAR ........... $1,545,439 $ 805,518 $ 602,585

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Cash paid during the year for:

Interest (excludes amounts capitalized) ..................... $ 20,861 $ 9,511 $ 14,761

Income taxes .......................................... $ 320,546 $ 351,003 $ 363,649

The accompanying notes are an integral part of these consolidated financial statements.

28