Costco 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Merchandise Inventories

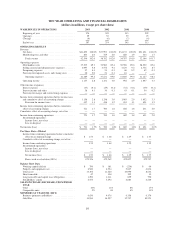

Merchandise inventories are valued at the lower of cost or market as determined primarily by the retail

method of accounting and are stated using the last-in, first-out (LIFO) method for substantially all U.S. merchan-

dise inventories. Merchandise inventories for all foreign operations are primarily valued by the retail method of

accounting, and are stated using the first-in, first-out (FIFO) method. The Company believes the LIFO method

more fairly presents the results of operations by more closely matching current costs with current revenues. The

Company records an adjustment each quarter for the expected annual effect of inflation, and these estimates are

adjusted to actual results determined at year-end. The Company considers in its calculation of the LIFO cost the

estimated net realizable value of inventory in those inventory pools where deflation exists and records a write

down of inventory where estimated net realizable value is less than LIFO inventory.

The Company provides for estimated inventory losses between physical inventory counts on the basis of a

percentage of sales. The provision is adjusted periodically to reflect the trend of the actual physical inventory

count results, which generally occur in the second and fourth fiscal quarters.

Inventory cost, where appropriate, is reduced by estimates of vendor rebates earned when those rebates are

deemed to be probable and reasonably estimable. Other consideration received from vendors is generally re-

corded as a reduction of merchandise costs upon completion of contractual milestones, terms of agreement, or

other systematic and rational approach.

Impairment of long-lived assets and warehouse closing costs

The Company periodically evaluates its long-lived assets for indicators of impairment. Management’s judg-

ments are based on market and operational conditions at the present time. Future events could cause management

to conclude that impairment factors exist, requiring an adjustment of these assets to their then-current fair market

value.

The Company provides estimates for warehouse closing costs when it is appropriate to do so based on ac-

counting principles generally accepted in the United States. Future circumstances may result in the Company’s

actual future closing costs or the amount recognized upon the sale of the property to differ substantially from the

original estimates.

Insurance/Self Insurance Liabilities

The Company uses a combination of insurance and self-insurance mechanisms to provide for the potential

liabilities for workers’ compensation, general liability, property insurance, director and officers’ liability, vehicle

liability and employee health care benefits. Liabilities associated with the risks that are retained by the Company

are estimated, in part, by considering historical claims experience and outside expertise, demographic factors,

severity factors and other actuarial assumptions. The estimated accruals for these liabilities could be significantly

affected if future occurrences and claims differ from these assumptions and historical trends.

Recent Accounting Pronouncements

In June 2001, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting

Standards No. 143 (SFAS No. 143), “Accounting for Asset Retirement Obligations,” which provides the

accounting requirements for retirement obligations associated with tangible long-lived assets. SFAS No. 143 re-

quires entities to record the fair value of a liability for an asset retirement obligation in the period in which it is

incurred. SFAS No. 143 was effective for the Company’s 2003 fiscal year. The adoption of SFAS No. 143 did

not have a material impact on the Company’s consolidated results of operations, financial position or cash flows.

In August 2001, the FASB issued SFAS No. 144, “Accounting for the Impairment or Disposal of Long-

Lived Assets,” effective for the Company’s 2003 fiscal year. This Statement supersedes FASB Statement No.

121, “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed Of” and

other related accounting guidance. The adoption of SFAS No. 144 did not have a material impact on the Compa-

ny’s consolidated results of operations, financial position, or cash flows.

18