Costco 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data) (Continued)

Note 1—Summary of Significant Accounting Policies (Continued)

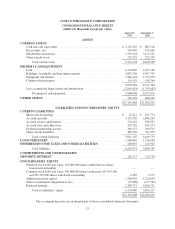

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market as determined primarily by the retail in-

ventory method, and are stated using the last-in, first-out (LIFO) method for substantially all U.S. merchandise

inventories. Merchandise inventories for all foreign operations are primarily valued by the retail method of ac-

counting, and are stated using the first-in, first-out (FIFO) method. The Company believes the LIFO method

more fairly presents the results of operations by more closely matching current costs with current revenues. The

Company records an adjustment each quarter for the expected annual effect of inflation and these estimates are

adjusted to actual results determined at year-end. The Company considers in its calculation of the LIFO cost the

estimated net realizable value of inventory in those inventory pools where deflation exists and records a write

down of inventory where estimated net realizable value is less than LIFO inventory. The LIFO inventory adjust-

ment for the fourth quarter of fiscal 2003 increased gross margin by approximately $14,650 as compared to

$21,000 in the fourth quarter of fiscal 2002. If all merchandise inventories had been valued using the first-in,

first-out (FIFO) method, inventories would have been lower by $19,500 at August 31, 2003 and higher by $150

at September 1, 2002.

August 31,

2003

September 1,

2002

Merchandise inventories consist of:

United States (primarily LIFO) ........................ $2,668,342 $2,552,820

Foreign (FIFO) .................................... 671,086 574,401

Total ........................................ $3,339,428 $3,127,221

The Company provides for estimated inventory losses between physical inventory counts on the basis of a

standard percentage of sales. This provision is adjusted periodically to reflect the actual shrinkage results of the

physical inventory counts, which generally occur in the second and fourth quarters of the Company’s fiscal year.

Property and Equipment

Property and equipment are stated at cost. Depreciation and amortization expenses are computed using the

straight-line method for financial reporting purposes. Buildings are generally depreciated over twenty-five to

thirty-five years; equipment and fixtures are depreciated over three to ten years; and leasehold improvements are

amortized over the initial term of the lease.

Interest costs incurred on property and equipment during the construction period are capitalized. The

amount of interest costs capitalized was $3,272 in fiscal 2003, $13,480 in fiscal 2002, and $19,157 in fiscal 2001.

Impairment of Long-Lived Assets

The Company periodically evaluates the realizability of long-lived assets for impairment when events or

changes in circumstances occur, which may indicate the carrying amount of the asset may not be recoverable.

The Company evaluates the carrying value of the asset by comparing the estimated future undiscounted cash

flows generated from the use of the asset and its eventual disposition with the asset’s reported net book value. In

accordance with Statement of Financial Accounting Standards (SFAS) No. 144, the Company recorded a pre-tax,

non-cash charge of $4,697 in fiscal 2003 and $0 and $15,231 in fiscal 2002 and 2001, respectively, reflecting its

estimate of impairment relating to scheduled warehouse closings. The charge reflects the difference between the

carrying value and fair value, which was based on estimated market valuations for those assets whose carrying

value is not currently anticipated to be recoverable through future cash flows.

30