Costco 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

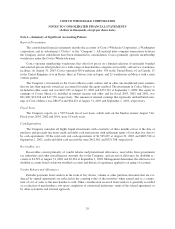

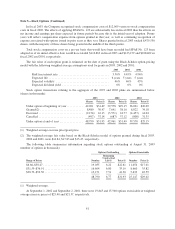

Note 1—Summary of Significant Accounting Policies (Continued)

Stock-Based Compensation

The Company adopted the fair value based method of recording stock options consistent with SFAS No. 123

“Accounting for Stock-Based Compensation,” for all employee stock options granted subsequent to fiscal year

end 2002. Specifically, the Company adopted SFAS No. 123 using the “prospective method” with guidance pro-

vided from SFAS No. 148 “Accounting for Stock-Based Compensation—Transition and Disclosure.” All

employee stock option grants made in fiscal 2003 and in future years will be expensed over the stock option vest-

ing period based on the fair value at the date the options are granted. Prior to fiscal 2003 the Company applied

Accounting Principles Board Opinion (APB) No. 25 and related interpretations in accounting for stock options.

Because the Company granted stock options to employees at exercise prices equal to fair market value on the

date of grant, accordingly, no compensation cost was recognized for option grants.

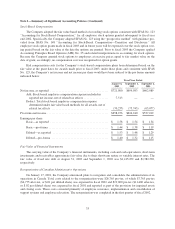

Had compensation costs for the Company’s stock-based compensation plans been determined based on the

fair value at the grant dates for awards made prior to fiscal 2003, under those plans and consistent with SFAS

No. 123, the Company’s net income and net income per share would have been reduced to the pro forma amounts

indicated below:

Fiscal Year Ended

August 31,

2003

September 1,

2002

September 2,

2001

Net income, as reported ........................................ $721,000 $699,983 $602,089

Add: Stock-based employee compensation expense included in

reported net income, net of related tax effects ................. 7,513 — —

Deduct: Total stock-based employee compensation expense

determined under fair value based methods for all awards, net of

related tax effects ....................................... (70,257) (75,743) (65,077)

Pro-forma net income .......................................... $658,256 $624,240 $537,012

Earnings per share:

Basic—as reported ........................................ $ 1.58 $ 1.54 $ 1.34

Basic—pro-forma ......................................... $ 1.44 $ 1.38 $ 1.19

Diluted—as reported ...................................... $ 1.53 $ 1.48 $ 1.29

Diluted—pro-forma ....................................... $ 1.40 $ 1.32 $ 1.15

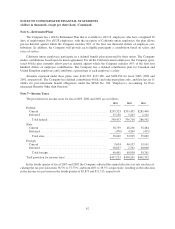

Fair Value of Financial Instruments

The carrying value of the Company’s financial instruments, including cash and cash equivalents, short-term

investments and receivables approximate fair value due to their short-term nature or variable interest rates. The

fair value of fixed rate debt at August 31, 2003 and September 1, 2002 was $1,415,252 and $1,382,569,

respectively.

Reorganization of Canadian Administrative Operations

On January 17, 2001, the Company announced plans to reorganize and consolidate the administration of its

operations in Canada. Total costs related to the reorganization were $26,765 pre-tax, of which $7,765 pre-tax

($4,775 after-tax, or $.01 per diluted share) was expensed in fiscal 2002 and $19,000 pre-tax ($11,400 after-tax,

or $.02 per diluted share) was expensed in fiscal 2001 and reported as part of the provision for impaired assets

and closing costs. These costs consisted primarily of employee severance, implementation and consolidation of

support systems and employee relocation. The reorganization was completed in the first quarter of fiscal 2002.

33