Costco 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letters of Credit

The Company has letter of credit facilities (for commercial and standby letters of credit), totaling approx-

imately $369,000. The outstanding commitments under these facilities at August 31, 2003 totaled approximately

$125,000, including approximately $44,000 in standby letters of credit.

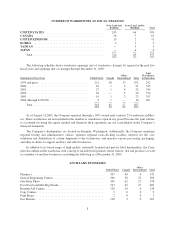

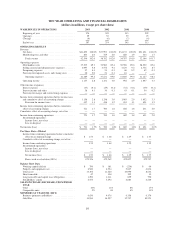

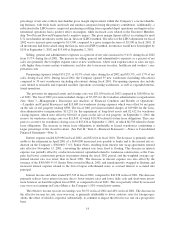

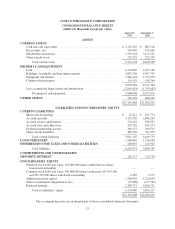

Contractual Obligations

The Company’s commitment to make future payments under long-term contractual obligations was as fol-

lows, as of August 31, 2003.

Payments Due by Period

Contractual obligations Total

Less than

1 year

1to3

years

4to5

years

After

5 years

Long-term debt(1) ........................ $1,702,618(2) $ 44,368 $361,542 $379,528 $ 917,180(2)

Capital lease obligations ................... 12,116 6,427 2,250 1,115 2,324

Operating leases ......................... 1,405,262(3) 85,862 173,996 162,101 983,303

Total .............................. $3,119,996 $136,657 $537,788 $542,744 $1,902,807

(1) Amounts include contractual interest payments.

(2) The amount includes interest accreted to maturity for the Company’s Zero Coupon 3

1

⁄

2

%Convertible Sub-

ordinated Notes due August 2017, totaling $851,860. The consolidated balance sheet as of August 31, 2003

reflects the current balance outstanding of $524,735.

(3) Operating lease obligations have been reduced by $142,975 to reflect sub-lease income.

Financing Activities

In April 2003, the Company’s wholly-owned Japanese subsidiary issued promissory notes bearing interest at

0.92% in the aggregate amount of approximately $34,376, through a private placement. Interest is payable semi-

annually and principal is due on April 26, 2010.

In November 2002, the Company’s wholly-owned Japanese subsidiary issued promissory notes bearing

interest at 0.88% in the aggregate amount of approximately $25,782, through a private placement. Interest is

payable semi-annually and principal is due on November 7, 2009.

In March 2002, the Company issued $300,000 of 5

1

⁄

2

% Senior Notes due March 15, 2007. Interest is pay-

able semi-annually. Simultaneous with the issuance of the Senior Notes, the Company entered into interest rate

swap agreements converting the interest from fixed to floating.

In February 1996, the Company filed with the Securities and Exchange Commission a shelf registration

statement for $500,000 of senior debt securities. On October 23, 2001, additional debt securities of $100,000

were registered, bringing the total amount of debt registered under the shelf registration to $600,000. The

$300,000 of 5

1

⁄

2

% Senior Notes issued in March 2002 reduced the amount of registered securities available for

future issuance to $300,000.

Derivatives

The Company has limited involvement with derivative financial instruments and uses them only to manage

well-defined interest rate and foreign exchange risks. Forward foreign exchange contracts are used to hedge the

impact of fluctuations of foreign exchange on inventory purchases and typically have very short terms. The ag-

gregate amount of foreign exchange contracts outstanding at August 31, 2003 was not material. The only sig-

nificant derivative instruments the Company holds are interest rate swaps, which the Company uses to manage

the interest rate risk associated with its borrowings and to manage the Company’s mix of fixed and variable-rate

debt. As of August 31, 2003, the Company had “fixed-to-floating” interest rate swaps with an aggregate notional

amount of $600,000 and an aggregate fair value of $34,204, which is recorded in other assets. These swaps were

16