Costco 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YEAR ENDED AUGUST 31, 2003

Annual

Report

2003

2003

Annual

Report

2003

Table of contents

-

Page 1

Annual Report 2003 2003 YEAR ENDED AUGUST 31, 2003 -

Page 2

... in Seattle, Washington. In October 1993, Costco merged with The Price Company, which had pioneered the membership warehouse concept in 1976, to form Price/Costco, Inc., a Delaware corporation. In January 1997, after the spin-off of most of its non-warehouse assets to Price Enterprises, Inc., the... -

Page 3

... 0 2002 2001 Fiscal Year 2003 * Income from continuing operations ** Income from continuing operations excluding asset impairment/closing costs and/or accounting change Comparable Sales Growth 16 12% Membership Gold Star Members 14.984 4.6 4.8 Business Members 4.636 11% 10% 15 14 13 14.597... -

Page 4

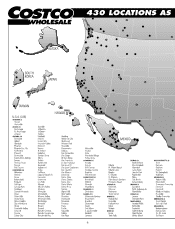

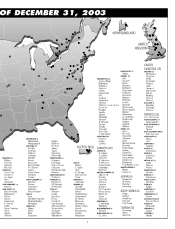

... of 430 Costcos...418 warehouses at our August 31st fiscal year-end, plus 12 openings since then...operating in 36 U.S. States and Puerto Rico and seven countries. Our mission has been to consistently bring quality goods and services to our members at the lowest possible price in every market where... -

Page 5

... St. Louis, Missouri; and Carolina, Puerto Rico); and 13 in established markets (Tracy, Rohnert Park, North Fresno, Vacaville and Folsom, California; Avondale, Arizona; Glenview and Naperville, Illinois; Everett, Massachusetts; Kirkland, Washington (the Costco Home store); Ocean Township, New Jersey... -

Page 6

... Black and Decker (DeWalt) tools, Jacob & Co. Watches, Bowflex, Schwinn Exercise, Celestron Telescope, Head Ski Gloves, Kurt Adler, Fender Guitar, Gateway Computer and Krups household appliances. Of course, underlying Costco's success are our 20+ million loyal members, representing 40+ million loyal... -

Page 7

... careers in both public and private service: Daniel J. Evans and William H. Gates, II. Mr. Evans is Chairman of Daniel J. Evans Associates, a consulting firm, and was previously a United States Senator and three-term Governor of the State of Washington. Mr. Gates is the CEO and Co-Chair of the Bill... -

Page 8

6 -

Page 9

7 -

Page 10

... number of warehouses open in any period because the joint venture is accounted for using the equity method and therefore their operations are not consolidated in the Company's financial statements. The Company's headquarters are located in Issaquah, Washington. Additionally, the Company maintains... -

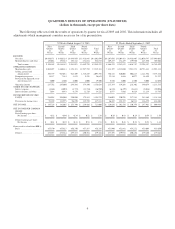

Page 11

... Second Quarter 12 Weeks Third Quarter 12 Weeks Fourth Quarter 16 Weeks Total 52 Weeks REVENUE Net sales ...$9,010,571 $ 9,920,324 $9,344,959 $13,416,845 $41,692,699 Membership fees and other ...188,014 193,843 198,112 272,884 852,853 Total revenue ...OPERATING EXPENSES Merchandise costs ...Selling... -

Page 12

...'s) ...Balance Sheet Data Working capital (deficit) ...Property and equipment, net ...Total assets ...Short-term debt ...Long-term debt and capital lease obligations ...Stockholders' equity ...SALES INCREASE (DECREASE) FROM PRIOR YEAR Total ...Comparable units ...MEMBERS AT YEAR END (000'S) Business... -

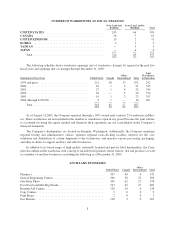

Page 13

1999 278 21 (7) 292 1998 261 18 (1) 278 1997 252 17 (8) 261 1996 240 20 (8) 252 1995 221 24 (5) 240 1994 200 29 (8) 221 $26,976 480 27,456 24,170 2,338 31 57 26,596 860 (45) 44 - 859 344 515 (118) 397 - - $ 397 100.0% 1.8 101.8 89.6 8.7 0.1 0.2 98.6 3.2 (0.2) 0.2 - 3.2 1.3 1.9 (0.4) 1.5 - - ... -

Page 14

... of net sales reflects merchandise gross margin improvement within the Company's ancillary warehouse businesses and international operations accounting for increases of 15 and 8 basis points, respectively. Additionally, increased rewards related to the Executive Membership Two-Percent Reward Program... -

Page 15

... $21,050 in fiscal 2002. The provision includes costs related to impairment of long-lived assets, future lease obligations of warehouses that have been relocated to new facilities and any losses or gains resulting from the sale of real property. The provision for fiscal 2003 included charges of $11... -

Page 16

... improved international operations had a positive effect on margins, while increased costs related to the Executive Membership Two-Percent Reward Program had a negative impact. The gross margin figures reflect accounting for most U.S. merchandise inventories on the last-in, first-out (LIFO) method... -

Page 17

... 25 new warehouse clubs, including two relocations to larger and better-located warehouses. The Company expects to continue its review of expansion plans in its international operations in existing markets including the United Kingdom and in Asia along with other international markets. Costco and... -

Page 18

... for the Company's Zero Coupon 3 1â„ 2% Convertible Subordinated Notes due August 2017, totaling $851,860. The consolidated balance sheet as of August 31, 2003 reflects the current balance outstanding of $524,735. (3) Operating lease obligations have been reduced by $142,975 to reflect sub-lease... -

Page 19

... financial position and results of operations. Management continues to review its accounting policies and evaluate its estimates, including those related to merchandise inventory, impairment of long-lived assets and warehouse closing costs and insurance/self-insurance liabilities. The Company bases... -

Page 20

...provide for the potential liabilities for workers' compensation, general liability, property insurance, director and officers' liability, vehicle liability and employee health care benefits. Liabilities associated with the risks that are retained by the Company are estimated, in part, by considering... -

Page 21

... for transition to the fair value based method of accounting for stock-based employee compensation and the required financial statement disclosure. Effective September 3, 2002 the Company adopted the fair value based method of accounting for stock-based compensation. See Note (1) and Note (5) of... -

Page 22

... material to the Company's results of operations or its financial position. Change in Accountants On May 13, 2002, the Audit Committee of Costco Wholesale Corporation's Board of Directors engaged KPMG LLP as the Company's firm of independent auditors for 2002. The information required by this item... -

Page 23

CERTIFICATIONS I, James D. Sinegal, certify that: 1) 2) I have reviewed this annual report on Form 10-K of Costco Wholesale Corporation; Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the ... -

Page 24

CERTIFICATIONS I, Richard A. Galanti, certify that: 1) 2) I have reviewed this annual report on Form 10-K of Costco Wholesale Corporation. Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the ... -

Page 25

... Board of Directors and Shareholders: We have audited the accompanying consolidated balance sheets of Costco Wholesale Corporation and subsidiaries as of August 31, 2003 and September 1, 2002 and the related consolidated statements of income, stockholders' equity and cash flows for the 52 weeks then... -

Page 26

... INDEPENDENT PUBLIC ACCOUNTANTS To Costco Wholesale Corporation: We have audited the accompanying consolidated balance sheets of Costco Wholesale Corporation (a Washington corporation) and subsidiaries ("Costco") as of September 2, 2001 and September 3, 2000, and the related consolidated statements... -

Page 27

COSTCO WHOLESALE CORPORATION CONSOLIDATED BALANCE SHEETS (dollars in thousands except par value) August 31, 2003 September 1, 2002 ASSETS CURRENT ASSETS Cash and cash equivalents ...Receivables, net ...Merchandise inventories ...Other current assets ...Total current assets ...PROPERTY AND EQUIPMENT... -

Page 28

COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (dollars in thousands, except per share data) 52 Weeks Ended August 31, 2003 52 Weeks Ended September 1, 2002 52 Weeks Ended September 2, 2001 REVENUE Net sales ...Membership fees and other ...Total revenue ...OPERATING EXPENSES ... -

Page 29

COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY For the 52 weeks ended August 31, 2003, the 52 weeks ended September 1, 2002 and the 52 weeks ended September 2, 2001 (in thousands) Common Stock Shares Amount Additional Paid-In Capital Other Accumulated Comprehensive ... -

Page 30

... discount on zero coupon notes ...17,852 17,233 16,654 Stock-based compensation ...12,069 - - Undistributed equity earnings in affiliates ...(21,612) (21,485) (17,719) Net loss/(gain) on sale of property and equipment and other ...4,907 4,001 (15,934) Provision for impaired assets ...4,697 - 15,231... -

Page 31

... the accounts of Costco Wholesale Corporation, a Washington corporation, and its subsidiaries ("Costco" or the "Company"). All material inter-company transactions between the Company and its subsidiaries have been eliminated in consolidation. Costco primarily operates membership warehouses under... -

Page 32

... inventories. Merchandise inventories for all foreign operations are primarily valued by the retail method of accounting, and are stated using the first-in, first-out (FIFO) method. The Company believes the LIFO method more fairly presents the results of operations by more closely matching current... -

Page 33

...provide for the potential liabilities for workers' compensation, general liability, property insurance, director and officers' liability, vehicle liability and employee health care benefits. Liabilities associated with the risks that are retained by the Company are estimated, in part, by considering... -

Page 34

... building and equipment depreciation, as well as other operating costs incurred to support warehouse operations. Marketing and Promotional Expenses Costco's policy is generally to limit marketing and promotional expenses to new warehouse openings, occasional direct mail marketing to prospective new... -

Page 35

... Principles Board Opinion (APB) No. 25 and related interpretations in accounting for stock options. Because the Company granted stock options to employees at exercise prices equal to fair market value on the date of grant, accordingly, no compensation cost was recognized for option grants. Had... -

Page 36

... (Continued) Note 1-Summary of Significant Accounting Policies (Continued) Closing Costs Warehouse closing costs incurred relate principally to the Company's efforts to relocate certain warehouses that were not otherwise impaired to larger and better-located facilities. The provision for fiscal 2003... -

Page 37

... as market conditions warrant. The repurchased shares would constitute authorized, but non-issued shares and would be used for general corporate purposes, including stock option grants under stock option programs. To date, no shares have been repurchased under this program. Recent Accounting... -

Page 38

... for transition to the fair value based method of accounting for stock-based employee compensation and the required financial statement disclosure. Effective September 3, 2002 the Company adopted the fair value based method of accounting for stock-based compensation. See Note (1) and Note (5) of... -

Page 39

...At August 31, 2003, no amounts were outstanding under the Canadian commercial paper program or the bank credit facility. The Company has agreed to limit the combined amount outstanding under the U.S. and Canadian commercial paper programs to the $343,000 combined amounts of the respective supporting... -

Page 40

... Notes due March 2007 ...2.070% Promissory notes due October 2007 ...1.187% Promissory notes due July 2008 ...0.88% Promissory notes due November 2009 ...0.92% Promissory notes due April 2010 ...3 1â„ 2% Zero Coupon convertible subordinated notes due August 2017 ...Notes payable secured by trust... -

Page 41

..., the Company retired its unsecured note payable to banks of $140,000 using cash provided from operations, cash and cash equivalents, and short-term borrowings under its commercial paper program. On August 19, 1997, the Company completed the sale of $900,000 principal amount at maturity Zero Coupon... -

Page 42

.... Prior to fiscal 2003 the Company applied APB No. 25 and related interpretations in accounting for stock options. Because the Company granted stock options to employees at exercise prices equal to fair market value on the date of grant, accordingly, no compensation cost was recognized for option... -

Page 43

....47, respectively. The following table summarizes information regarding stock options outstanding at August 31, 2003 (number of options in thousands): Options Outstanding Remaining Contractual Number Life(1) Price(1) Options Exercisable Range of Prices Number Price(1) $6.66-$30.47 ...$31.55-$36... -

Page 44

...) Note 6-Retirement Plans The Company has a 401(k) Retirement Plan that is available to all U.S. employees who have completed 90 days of employment. For all US employees, with the exception of California union employees, the plan allows pre-tax deferral against which the Company matches 50% of... -

Page 45

...from its business and property ownership. The Company is a defendant in two actions purportedly brought as class actions on behalf of certain present and former Costco managers in California, in which plaintiffs allege that they have not been properly compensated for overtime work. Presently, claims... -

Page 46

...Canada, Japan and through majority-owned subsidiaries in the United Kingdom, Taiwan and Korea and through a 50%-owned joint venture in Mexico. The Company's reportable segments are based on management responsibility and exclude the Mexico joint-venture, as it is accounted for under the equity method... -

Page 47

MARKET FOR COSTCO COMMON STOCK Costco Common Stock is quoted on The Nasdaq Stock Market's National Market under the symbol "COST." The following table sets forth the closing high and low sales prices of Costco Common Stock..., 2003 the Company had 7,807 stockholders of record. DIVIDEND POLICY $46.250 ... -

Page 48

... Franz E. Lazarus Executive Vice President, COO-International Operations, Manufacturing & Ancillary Businesses Jeffrey R. Long Senior Vice President, General Manager- Northeast Region John Matthews Senior Vice President, Human Resources & Risk Management John McKay Senior Vice President, General... -

Page 49

... Manager- Eastern Canada Region Ginnie Roeglin Senior Vice President, Membership, Marketing, Member Services & Publishing Timothy L. Rose Senior Vice President, Merchandising-Foods, Sundries & Fresh Foods Doug Schutt Senior Vice President, E-commerce, Business Delivery & Special Order, Costco Home... -

Page 50

...-Western Canada Region Gary Ojendyk GMM-Corporate Non-Foods Richard J. Olin Legal, General Counsel Mario Omoss Operations-Texas Region John R. Osterhaus Photo, Optical & Hearing Aids Steve Pappas Country Manager-Korea Shawn Parks Operations-Los Angeles Region Roger E. Peterson Operations-San Diego... -

Page 51

... Region 11000 Garden Grove, #201 Garden Grove, CA 92843 San Diego Region 4455 Morena Blvd. San Diego, CA 92117 Arizona Region 17550 N. 79th Ave., Suite 2 Glendale, AZ 85308 Texas Region 1701 Dallas Parkway, Suite 201 Plano, TX 75093 Canadian Division Eastern Region 415 Hunt Club Road West Ottawa, ON... -

Page 52

PRINTED ON RECYCLED PAPER