Costco 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

Note 2ÌDebt (Continued)

In April 1996, the Company borrowed $140,000 from a group of banks under a Ñve-year unsecured term

loan. Interest only is payable quarterly at rates based on LIBOR.

On August 19, 1997, the Company completed the sale of $900,000 principal amount at maturity of Zero

Coupon Subordinated Notes (the ""Notes'') due August 19, 2017. The Notes were priced with a yield to

maturity of 3¥%, resulting in gross proceeds to the Company of $449,640. The Notes are convertible into a

maximum of 20,438,180 shares of Costco Common Stock at an initial conversion price of $22.00. Holders of

the Notes may require the Company to purchase the Notes (at the discounted issue price plus accrued interest

to date of purchase) on August 19, 2002, 2007, or 2012. The Company, at its option, may redeem the Notes

(at the discounted issue price plus accrued interest to date of redemption) any time on or after August 19,

2002. As of September 3, 2000, $48,123 in principal amount of the Zero Coupon Notes were converted by

note holders to shares of Costco Common Stock.

In February, 1996, the Company Ñled with the Securities and Exchange Commission a shelf registration

statement for $500,000 of senior debt securities. Although the registration statement was declared eÅective, no

securities have been issued under this Ñling.

At September 3, 2000, the fair value of the 7±% Senior Notes, based on market quotes, was

approximately $300,120. The Senior Notes are not redeemable prior to maturity. The fair value of the 3¥%

Zero Coupon Subordinated Notes at September 3, 2000, based on market quotes, was approximately

$727,418. The fair value of other long-term debt approximates carrying value.

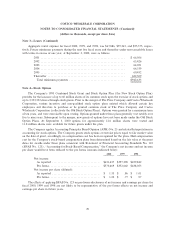

Maturities of long-term debt during the next Ñve Ñscal years and thereafter are as follows:

2001 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $148,749

2002 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3,829

2003 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,586

2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,264

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 301,396

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 481,978

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $938,802

Note 3ÌLeases

The Company leases land and/or warehouse buildings at 68 of the 313 warehouses open at September 3,

2000, and certain other oÇce and distribution facilities under operating leases with remaining terms ranging

from 1 to 30 years. These leases generally contain one or more of the following options which the Company

can exercise at the end of the initial lease term: (a) renewal of the lease for a deÑned number of years at the

then fair market rental rate; (b) purchase of the property at the then fair market value; or (c) right of Ñrst

refusal in the event of a third party purchase oÅer. Certain leases provide for periodic rental increases based on

the price indices and some of the leases provide for rents based on the greater of minimum guaranteed

amounts or sales volume. Contingent rents have not been material.

Additionally, the Company leases certain equipment and Ñxtures under short-term operating leases that

permit the Company to either renew for a series of one-year terms or to purchase the equipment at the then

fair market value.

28