Costco 2000 Annual Report Download - page 13

Download and view the complete annual report

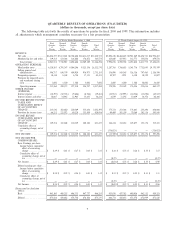

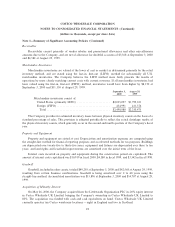

Please find page 13 of the 2000 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.EÅective with the Ñrst quarter of Ñscal 1999, the Company changed its method of accounting for

membership fee income from a ""cash basis'' to a ""deferred basis'', whereby membership fee income is

recognized ratably over the one-year life of the membership. If the deferred method had been used in Ñscal

1998, membership fees and other would have been reduced by $25,651 to $413,846, or 1.74% of net sales, and

the year-over-year increase would have been 16%.

Gross margin (deÑned as net sales minus merchandise costs) increased 15% to $2,806,254, or 10.40% of

net sales, in Ñscal 1999 from $2,450,689, or 10.28% of net sales, in Ñscal 1998. Gross margin as a percentage of

net sales increased due to increased sales penetration of certain higher gross margin ancillary businesses,

favorable inventory shrink results, and improved performance of the Company's international operations. The

gross margin Ñgures reÖect accounting for most U.S. merchandise inventories on the last-in, Ñrst-out

(LIFO) method. If all inventories had been valued under the Ñrst-in, Ñrst-out (FIFO) method, inventories

would have been higher by $11,150 at August 29, 1999 and $16,150 at August 30, 1998.

Selling, general and administrative expenses as a percent of net sales decreased to 8.67% during Ñscal

1999 from 8.69% during Ñscal 1998. This decrease primarily reÖects the increase in comparable warehouse

sales noted above, and a year-over-year improvement in the Company's core warehouse operations and

Central and Regional administrative oÇces, which were partially oÅset by higher expenses associated with

international expansion and certain ancillary businesses.

Preopening expenses totaled $31,007, or 0.11% of net sales, during Ñscal 1999 and $27,010, or 0.11% of

net sales, during Ñscal 1998. During Ñscal 1999, the Company opened 21 new warehouses compared to 16 new

warehouses during Ñscal 1998. Pre-opening expenses also include costs related to remodels, expanded fresh

foods and ancillary operations at existing warehouses.

The provision for impaired assets and warehouse closing costs was $56,500 in Ñscal 1999 compared to

$6,000 in Ñscal 1998. The Ñscal 1999 provision includes a charge of $31,080 for the impairment of long-lived

assets and $30,865 for warehouse and other facility closing costs, which were oÅset by $5,445 of gains on the

sale of real property. The provision for warehouse closing costs includes $24,773 for lease obligations and

$6,092 for other expenses directly related to the closedown of warehouses and other facilities. The increase in

warehouse closing costs is primarily attributable to the Company's decision in the fourth quarter of Ñscal 1999

to relocate several warehouses (which were not otherwise impaired) to larger and better-located facilities.

Interest expense totaled $45,527 in Ñscal 1999, and $47,535 in Ñscal 1998. The decrease in interest

expense is primarily due to an increase in capitalized interest related to construction projects.

Interest income and other totaled $44,266 in Ñscal 1999 compared to $26,662 in Ñscal 1998. The increase

was primarily due to interest earned on higher balances of cash and cash equivalents and short-term

investments during Ñscal 1999 as compared to Ñscal 1998.

The eÅective income tax rate on earnings was 40% in both Ñscal 1999 and Ñscal 1998.

Liquidity and Capital Resources (dollars in thousands)

Expansion Plans

Costco's primary requirement for capital is the Ñnancing of the land, building and equipment costs for

new warehouses plus the costs of initial warehouse operations and working capital requirements, as well as

additional capital for international expansion through investments in foreign subsidiaries and joint ventures.

While there can be no assurance that current expectations will be realized, and plans are subject to

change upon further review, it is management's current intention to spend an aggregate of approximately

$900,000 to $1,100,000 during Ñscal 2001 in the United States and Canada for real estate, construction,

remodeling and equipment for warehouse clubs and related operations; and approximately $150,000 to

$200,000 for international expansion, including the United Kingdom, Asia, Mexico and other potential

ventures. These expenditures will be Ñnanced with a combination of cash provided from operations, the use of

cash and cash equivalents and short-term investments (which totaled $572,531 at September 3, 2000), short-

term borrowings under revolving credit facilities and other Ñnancing sources as required.

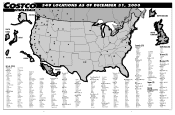

Expansion plans for the United States and Canada during Ñscal 2001 are to open approximately 34 to

36 new warehouse clubs, including 5 to 6 relocations of existing warehouses to larger and better-located

12