Costco 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

Note 1ÌSummary of SigniÑcant Accounting Policies (Continued)

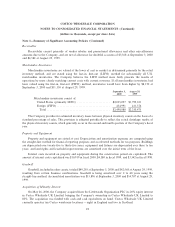

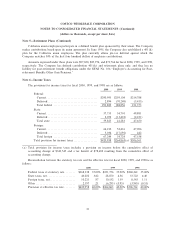

Impairment of Long-Lived Assets

The Company adopted the SFAS No. 121, ""Accounting for the Impairment of Long-Lived Assets and

for Long-Lived Assets to Be Disposed Of'' (SFAS No. 121), as of the Ñrst quarter of Ñscal 1997. In

accordance with SFAS No. 121, the Company recorded pretax, non-cash charges of $10,956, $31,080, and

$5,629 in Ñscal 2000, 1999 and 1998, respectively, reÖecting its estimate of impairment relating principally to

excess property and closed warehouses. The charge reÖects the diÅerence between carrying value and fair

value, which was based on market valuations for those assets whose carrying value was not recoverable

through future cash Öows. The Company periodically evaluates the realizability of long-lived assets based on

expected future cash Öows.

Warehouse Closing Costs

Warehouse closing costs incurred relate principally to the Company's eÅorts to relocate certain

warehouses that were not otherwise impaired to larger and better-located facilities. As of September 3, 2000,

the Company's reserve for warehouse closing costs was $11,762, of which $8,887 related to lease obligations.

Income Taxes

The Company accounts for income taxes under the provisions of Statement of Financial Accounting

Standards (SFAS) No. 109, ""Accounting for Income Taxes.'' That standard requires companies to account

for deferred income taxes using the asset and liability method.

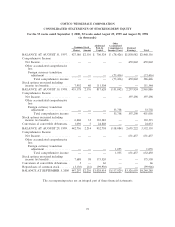

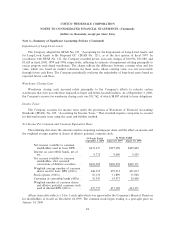

Net Income Per Common and Common Equivalent Share

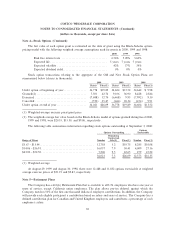

The following data show the amounts used in computing earnings per share and the eÅect on income and

the weighted average number of shares of dilutive potential common stock.

52 Weeks Ended

53 Weeks Ended

September 3, 2000 August 29, 1999 August 30, 1998

Net income available to common

stockholders used in basic EPS ÏÏÏÏÏ $631,437 $397,298 $459,842

Interest on convertible bonds, net of

tax ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,772 9,640 9,529

Net income available to common

stockholders after assumed

conversions of dilutive securitiesÏÏÏÏÏ $641,209 $406,938 $469,371

Weighted average number of common

shares used in basic EPS (000's) ÏÏÏ 446,255 439,253 431,013

Stock options (000's) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,135 11,890 11,920

Conversion of convertible bonds (000's) ÏÏ 19,347 19,977 20,438

Weighted number of common shares

and dilutive potential common stock

used in diluted EPS (000's) ÏÏÏÏÏÏÏÏ 475,737 471,120 463,371

All per share data reÖects a 2-for-1 stock split which was approved by the Company's Board of Directors

for shareholders of record on December 24,1999. The common stock began trading at a post-split price on

January 14, 2000.

24