Costco 2000 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2000 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COSTCO WHOLESALE CORPORATION

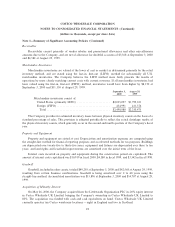

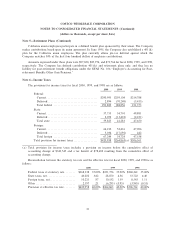

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

Note 1ÌSummary of SigniÑcant Accounting Policies (Continued)

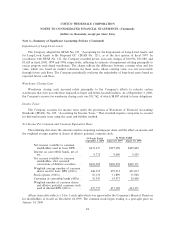

The diluted share base calculation for Ñscal years ended September 3, 2000, August 29, 1999 and

August 30, 1998 excludes 3,659,000, 4,797,000 and 375,000 stock options outstanding, respectively. These

options are excluded due to their anti-dilutive eÅect as a result of their exercise prices being greater than the

average market price of the common shares during those Ñscal years.

In November 1998, the Company's Board of Directors authorized a stock repurchase program of up to

$500,000 of Costco Common Stock over the next three years. Under the program, the Company may

repurchase shares from time to time in the open market or in private transactions as market conditions

warrant. The Company expects to fund stock purchases from cash and short-term investments on hand, as

well as from future operating cash Öows. The repurchased shares would constitute authorized but unissued

shares and would be used for general corporate purposes including stock option grants under stock option

programs. As of September 3, 2000, the Company had repurchased 3.13 million shares of common stock at an

average price of $31.96 per share, totaling approximately $99,946 excluding commissions.

Supplemental Disclosure of SigniÑcant Non-Cash Activities

Fiscal 2000 Non-Cash Activities

‚ None.

Fiscal 1999 Non-Cash Activities

‚ In March 1999, approximately $48,000 principal amount of the $900,000, 3¥% Zero Coupon

Convertible Subordinated Notes were converted into approximately 1.09 million shares of Costco

Common Stock.

Fiscal 1998 Non-Cash Activities

‚ None.

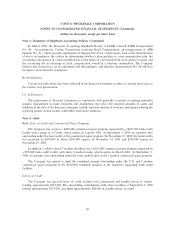

Recent Accounting Pronouncements

During June 1998, the Financial Accounting Standards Board issued Statement of Financial Accounting

Standards (SFAS) No. 133, Accounting for Derivative and Hedging Activities, and in June 2000, issued

SFAS 138, Accounting for Certain Derivative Instruments and Certain Hedging Activities, an amendment of

SFAS 133. These new standards require companies to record derivative Ñnancial instruments on the balance

sheet as assets or liabilities, measured at fair value. Gains or losses resulting from changes in the fair value of

those derivatives would be accounted for based on the use of the derivative and whether the instrument

qualiÑed for hedge accounting, as deÑned in SFAS 133 and 138. The Company was required to adopt the

provisions of SFAS 133 and 138 on September 4, 2000, the Ñrst day of Ñscal 2001. The Company's use of

derivative instruments is limited to the Ñxed-to-Öoating swap contract on its 7±% Senior Notes and foreign

exchange contracts and the impact of adoption was not material.

In December 1999, the staÅ of the Securities and Exchange Commission released StaÅ Accounting

Bulletin, or SAB, No. 101, ""Revenue Recognition'', to provide guidance on the recognition, presentation, and

disclosure of revenues in Ñnancial statements. The Company believes that its revenue recognition practices are

currently in conformity with the guidelines in SAB 101, as revised, and that this pronouncement will have no

impact on its Ñnancial statements.

25