Costco 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

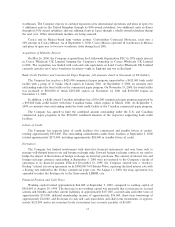

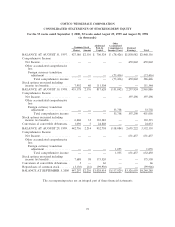

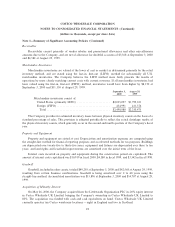

COSTCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

For the 53 weeks ended September 3, 2000, 52 weeks ended August 29, 1999 and August 30, 1998

(in thousands)

Other

Additional Accumulated

Common Stock Paid-In Comprehensive Retained

Shares Amount Capital Income/(Loss) Earnings Total

BALANCE AT AUGUST 31, 1997 ÏÏ 427,186 $2,136 $ 706,324 $ (78,426) $1,838,082 $2,468,116

Comprehensive Income

Net IncomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì 459,842 459,842

Other accumulated comprehensive

loss

Foreign currency translation

adjustmentÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì (73,416) Ì (73,416)

Total comprehensive income Ì Ì Ì (73,416) 459,842 386,426

Stock options exercised including

income tax beneÑtsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,992 40 111,304 Ì Ì 111,344

BALANCE AT AUGUST 30, 1998 ÏÏ 435,178 2,176 817,628 (151,842) 2,297,924 2,965,886

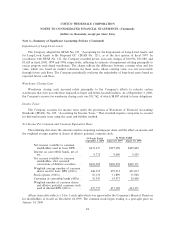

Comprehensive Income

Net IncomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì 397,298 397,298

Other accumulated comprehensive

loss

Foreign currency translation

adjustmentÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì 33,758 Ì 33,758

Total comprehensive income Ì Ì Ì 33,758 397,298 431,056

Stock options exercised including

income tax beneÑtsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,468 33 110,282 Ì Ì 110,315

Conversion of convertible debenturesÏÏ 1,090 5 24,848 Ì Ì 24,853

BALANCE AT AUGUST 29, 1999 ÏÏ 442,736 2,214 952,758 (118,084) 2,695,222 3,532,110

Comprehensive Income

Net IncomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì 631,437 631,437

Other accumulated comprehensive

loss

Foreign currency translation

adjustmentÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì 1,055 Ì 1,055

Total comprehensive income Ì Ì Ì 1,055 631,437 632,492

Stock options exercised including

income tax beneÑtsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,688 38 175,520 Ì Ì 175,558

Conversion of convertible debenturesÏÏ 3 Ì 66 Ì Ì 66

Repurchases of common stock ÏÏÏÏÏÏÏ (3,130) (16) (99,930) Ì Ì (99,946)

BALANCE AT SEPTEMBER 3, 2000 447,297 $2,236 $1,028,414 $(117,029) $3,326,659 $4,240,280

The accompanying notes are an integral part of these Ñnancial statements

19