Costco 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

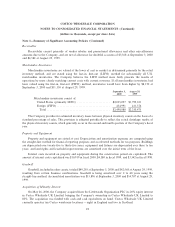

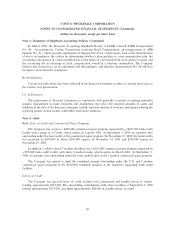

Note 1ÌSummary of SigniÑcant Accounting Policies (Continued)

In March 2000, the Financial Accounting Standards Board, or FASB, released FASB Interpretation

No. 44, ""Accounting for Certain Transactions involving Stock Compensation, an interpretation of APB

Opinion No. 25,'' which provides clariÑcation of Opinion No. 25 for certain issues, such as the determination

of who is an employee, the criteria for determining whether a plan qualiÑes as a non-compensatory plan, the

accounting consequence of various modiÑcations to the terms of a previously Ñxed stock option or award, and

the accounting for an exchange of stock compensation awards in a business combination. The Company

believes that its practices are in conformity with this guidance, and therefore Interpretation No. 44 will have

no impact on its Ñnancial statements.

ReclassiÑcations

Certain reclassiÑcations have been reÖected in the Ñnancial statements in order to conform prior years to

the current year presentation.

Use of Estimates

The preparation of Ñnancial statements in conformity with generally accepted accounting principles

requires management to make estimates and assumptions that aÅect the reported amounts of assets and

liabilities at the date of the Ñnancial statements and the reported amounts of revenues and expenses during the

reporting period. Actual results could diÅer from those estimates.

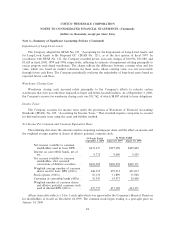

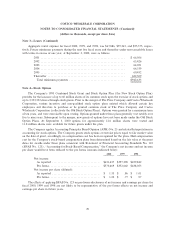

Note 2ÌDebt

Bank Lines of Credit and Commercial Paper Programs

The Company has in place a $425,000 commercial paper program supported by a $425,000 bank credit

facility with a group of 11 banks, which expires in January 2001. At September 3, 2000, no amounts were

outstanding under the loan facility or the commercial paper program. On November 15, 2000, the bank facility

was increased to $500,000 of which $250,000 expires on November 14, 2001 and $250,000 expires on

November 15, 2005.

In addition, a wholly owned Canadian subsidiary has a $136,000 commercial paper program supported by

a $95,000 bank credit facility with three Canadian banks, which expires in March 2001. At September 3,

2000, no amounts were outstanding under the bank credit facility or the Canadian commercial paper program.

The Company has agreed to limit the combined amount outstanding under the U.S. and Canadian

commercial paper programs to the $520,000 combined amounts of the respective supporting bank credit

facilities.

Letters of Credit

The Company has separate letter of credit facilities (for commercial and standby letters of credit),

totaling approximately $372,000. The outstanding commitments under these facilities at September 3, 2000

totaled approximately $273,000, including approximately $28,000 in standby letters of credit.

26