Costco 2000 Annual Report Download - page 15

Download and view the complete annual report

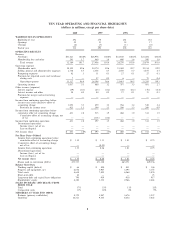

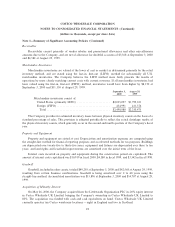

Please find page 15 of the 2000 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net cash provided by operating activities totaled $1,070,358 in Ñscal 2000 compared to $940,863 in Ñscal

1999. The increase in net cash from operating activities is primarily a result of increased net income, adjusted

for the non-cash cumulative eÅect of accounting change.

Net cash used in investing activities totaled $1,045,664 in Ñscal 2000 compared to $953,923 in Ñscal 1999.

The investing activities primarily relate to additions to property and equipment for new and remodeled

warehouses of $1,228,421 and $787,935 in Ñscal 2000 and 1999, respectively. The Company opened

25 warehouses during Ñscal 2000 compared to 21 warehouses opened during Ñscal 1999. In addition, the

Company plans to open approximately 15 new warehouses, including four relocations, in the Ñrst quarter of

Ñscal 2001 as compared to the 6 new warehouses opened in the Ñrst quarter of Ñscal 2000. In Ñscal 2000, the

Company purchased an additional 20% interest in Costco UK from Littlewoods Organisation PLC. Net cash

used in investing activities also reÖects a decrease in short-term investments of $208,959 since the beginning of

Ñscal 2000.

Net cash provided by Ñnancing activities totaled $58,605 in Ñscal 2000 compared to $85,845 in Ñscal

1999. This decrease is primarily due to the repurchase of 3.13 million shares of common stock partially oÅset

by the proceeds from the exercise of stock options and an increase in bank overdrafts.

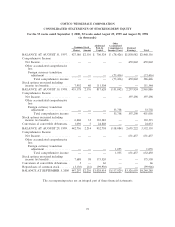

The Company's balance sheet as of September 3, 2000 reÖects a $1,128,939 or 15% increase in total

assets since August 29, 1999. The increase is primarily due to a net increase in property and equipment and

merchandise inventory related to the Company's expansion program oÅset by a decrease in cash and cash

equivalents and short-term investments.

Stock Repurchase Program (dollars in thousands except per share data)

On November 5, 1998, the Company announced that its Board of Directors had authorized a stock

repurchase program of up to $500,000 of Costco Common Stock over the subsequent three years. Under the

program, the Company may repurchase shares from time to time in the open market or in private transactions

as market conditions warrant. The Company expects to fund stock purchases from cash and short-term

investments on hand, as well as from future operating cash Öows. The repurchased shares would constitute

authorized, but unissued shares and would be used for general corporate purposes including stock option

grants under stock option programs. As of September 3, 2000, the Company had repurchased 3.13 million

shares of common stock at an average price of $31.96 per share, totaling approximately $99,946 (excluding

commissions).

Year 2000

The Company implemented an extensive project to ensure that its systems were Year 2000 compliant and

fully operational prior to the year 2000 and on into the 21st Century. Virtually all systemsÌincluding

information technology systems and non-information technology equipmentÌhave worked properly in the

year 2000. In addition, the Company has not experienced any material year 2000-related problems with its

signiÑcant suppliers with which its systems interface or exchange data. The total costs related to the Year 2000

eÅorts were approximately $7,500Ìin line with prior estimates and were fully expensed as incurred during the

relevant Ñscal periods.

Membership Fee Increases

EÅective September 1, 2000, the Company has increased annual membership fees for its Gold Star

(individual), Business, and Business Add-on Members. These fee increases, averaging approximately $5 per

member across all member categories, will allow the Company to be even more competitive in the future, and

pass on additional savings to its more than 18 million members worldwide.

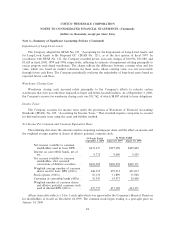

Recent Accounting Pronouncements

During June 1998, the Financial Accounting Standards Board (FASB) issued Statement of Financial

Accounting Standards (SFAS) No. 133, Accounting for Derivative and Hedging Activities, and in June 2000

issued SFAS 138, Accounting for Certain Derivative Instruments and Certain Hedging Activities, an

amendment of SFAS 133. These new standards require companies to record derivative Ñnancial instruments

on the balance sheet as assets or liabilities, measured at fair value. Gains or losses resulting from changes in

14