Costco 2000 Annual Report Download - page 14

Download and view the complete annual report

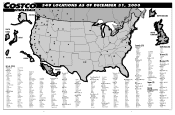

Please find page 14 of the 2000 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.warehouses. The Company expects to continue expansion of its international operations and plans to open 2 to

3 additional units in the United Kingdom through its 80%-owned subsidiary, two additional units in Korea

through its 95%-owned subsidiary and one additional unit in Japan through a wholly-owned subsidiary during

the next year. Other international markets are being assessed.

Costco and its Mexico-based joint venture partner, Controladora Comercial Mexicana, each own a

50% interest in Costco Mexico. As of September 3, 2000, Costco Mexico operated 18 warehouses in Mexico

and plans to open one to two new warehouse clubs during Ñscal 2001.

Acquisition of Minority Interest

On May 26, 2000, the Company acquired from the Littlewoods Organisation PLC its 20% equity interest

in Costco Wholesale UK Limited, bringing the Company's ownership in Costco Wholesale UK Limited

to 80%. The acquisition was funded with cash and cash equivalents on hand. Costco Wholesale UK Limited

currently operates ten Costco warehouse locationsÌeight in England and two in Scotland.

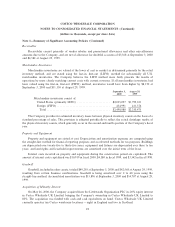

Bank Credit Facilities and Commercial Paper Programs (all amounts stated in thousands of US dollars)

The Company has in place a $425,000 commercial paper program supported by a $425,000 bank credit

facility with a group of 11 banks, which expires in January 2001. At September 3, 2000, no amounts were

outstanding under the loan facility or the commercial paper program. On November 15, 2000, the bank facility

was increased to $500,000 of which $250,000 expires on November 14, 2001 and $250,000 expires on

November 15, 2005.

In addition, a wholly owned Canadian subsidiary has a $136,000 commercial paper program supported by

a $95,000 bank credit facility with three Canadian banks, which expires in March, 2001. At September 3,

2000, no amounts were outstanding under the bank credit facility or the Canadian commercial paper program.

The Company has agreed to limit the combined amount outstanding under the U.S. and Canadian

commercial paper programs to the $520,000 combined amounts of the respective supporting bank credit

facilities.

Letters of Credit

The Company has separate letter of credit facilities (for commercial and standby letters of credit),

totaling approximately $372,000. The outstanding commitments under these facilities at September 3, 2000

totaled approximately $273,000, including approximately $28,000 in standby letters of credit.

Derivatives

The Company has limited involvement with derivative Ñnancial instruments and uses them only to

manage well-deÑned interest rate and foreign exchange risks. Forward foreign exchange contracts are used to

hedge the impact of Öuctuations of foreign exchange on inventory purchases. The amount of interest rate and

foreign exchange contracts outstanding at September 3, 2000 were not material to the Company's results of

operations or its Ñnancial position. EÅective December 10, 1999, the Company entered into a ""Ñxed-to-

Öoating'' interest rate swap agreement on its $300,000 7±% Senior Notes, replacing the Ñxed interest rate with

a Öoating rate indexed to the 30-day commercial paper rate. On August 11, 2000, the swap agreement was

amended to index the Öoating rate to the three-month LIBOR rate.

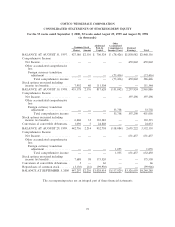

Financial Position and Cash Flows

Working capital totaled approximately $66,000 at September 3, 2000, compared to working capital of

$450,000 at August 29, 1999. The decrease in net working capital was primarily due to increases in accrued

salaries and beneÑts and other current liabilities of approximately $171,000, accrued sales and other taxes of

approximately $37,000, deferred membership income of approximately $36,000, short-term borrowings of

approximately $10,000, and decreases in cash and cash equivalents and short-term investments of approxi-

mately $125,000 and in net inventory levels (inventories less accounts payable) of $5,000.

13