Costco 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the fair value of those derivatives would be accounted for based on the use of the derivative and whether the

instrument qualiÑed for hedge accounting, as deÑned in SFAS 133 and 138. The Company was required to

adopt the provisions of SFAS 133 and 138 on September 4, 2000, the Ñrst day of Ñscal 2001. The Company's

use of derivative instruments is limited to the Ñxed-to-Öoating swap contract on its 7±% Senior Notes and

foreign exchange contracts and the impact of adoption was not material.

In December 1999, the staÅ of the Securities and Exchange Commission released StaÅ Accounting

Bulletin, or SAB, No. 101, ""Revenue Recognition'', to provide guidance on the recognition, presentation, and

disclosure of revenues in Ñnancial statements. The Company believes that its revenue recognition practices are

in conformity with the guidelines in SAB 101, as revised, and that this pronouncement will have no impact on

its Ñnancial statements.

In March 2000, the FASB released Interpretation No. 44, ""Accounting for Certain Transactions

involving Stock Compensation, an interpretation of APB Opinion No. 25,'' which provides clariÑcation of

Opinion No. 25 for certain issues, such as the determination of who is an employee, the criteria for

determining whether a plan qualiÑes as a non-compensatory plan, the accounting consequence of various

modiÑcations to the terms of a previously Ñxed stock option or award, and the accounting for an exchange of

stock compensation awards in a business combination. The Company believes that its practices are in

conformity with this guidance, and therefore Interpretation No. 44 will have no impact on its Ñnancial

statements.

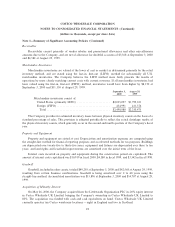

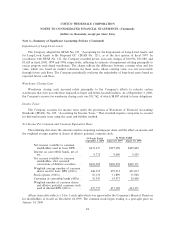

Quantitative and Qualitative Disclosure of Market Risk

The Company is exposed to Ñnancial market risk resulting from changes in interest and currency rates.

As a policy, the Company does not engage in speculative or leveraged transactions, nor hold or issue Ñnancial

instruments for trading purposes.

The nature and amount of the Company's long and short-term debt can be expected to vary as a result of

future business requirements, market conditions and other factors. As of September 3, 2000, approxi-

mately 54% of the Company's debt is Ñxed rate. The Company's primary interest rate exposure results from

changes in LIBOR which is used to determine the interest rate applicable to its $300,000 7±% Senior Notes

and $140,000 unsecured note payable to banks. EÅective December 10, 1999, the Company entered into a

""Ñxed-to-Öoating'' interest rate swap agreement on the $300,000 7±% Senior Notes, replacing the Ñxed

interest rate with a Öoating rate indexed to the 30-day commercial paper rate. On August 11, 2000 the swap

agreement was amended to index the Öoating rate to the three-month LIBOR rate. The Company's potential

increase in interest expense over one year that would result from a hypothetical, instantaneous and unfavorable

change of 100 basis points in the interest rate of its variable rate obligations would be approximately $4,400

pre-tax.

The Company's long-term debt also includes its $900,000 principal amount at maturity Zero Coupon

Subordinated Notes. While Öuctuations in interest rates may aÅect the fair value of this debt, interest expense

will not be aÅected due to the Ñxed interest rate of the Notes.

The Company's short-term investments as of September 3, 2000, include corporate notes and bonds and

certiÑcates of deposit with maturities of less than sixty days. These investments are classiÑed as available for

sale. If interest rates were to increase or decrease immediately, it could have a material impact on the fair

value of these investments. However, changes in interest rates would not likely have a material impact on

interest income.

Most foreign currency transactions have been conducted in local currencies, limiting the Company's

exposure to changes in currency rates. The Company periodically enters into forward foreign exchange

contracts to hedge the impact of Öuctuations in foreign currency rates on inventory purchases. The foreign

exchange contracts outstanding at September 3, 2000, were not material to the Company's results of

operations or its Ñnancial position.

15