Clearwire 2007 Annual Report Download - page 94

Download and view the complete annual report

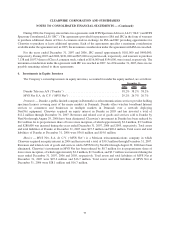

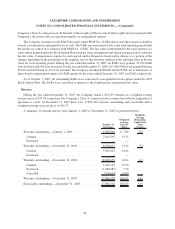

Please find page 94 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.primarily due to the write-off of the unamortized portion of the proceeds allocated to the warrants originally issued

in connection with the senior secured notes and the related deferred financing costs. In connection with the

$1.0 billion senior term loan facility, the Company recorded a deferred financing cost of $27.7 million which is

being amortized over the five year term of the loan.

On November 2, 2007, the Company entered into an Incremental Facility Amendment (the “Amendment”)

with Morgan Stanley Senior Funding, Inc, as administrative agent, term lender and co-lead arranger, Wachovia

Bank N.A. as term lender, and Wachovia Capital Markets, LLC, as co-lead arranger, which amended the Credit

Agreement dated July 3, 2007 (the “Credit Agreement”) to provide the Company with an additional $250.0 million

in term loans. The Company recorded a deferred financing cost of $2.5 million related to this additional funding,

which is being amortized over the remaining term of the loan. This additional funding, which closed on the same

date, increases the size of the Company’s senior secured term loan facility to $1.25 billion. The Company will use

the additional proceeds to further support its expansion plans and for general corporate purposes. The material terms

of the incremental term loans are the same as the terms of the loans under the original senior secured term loan

facility.

As of December 31, 2007, $1.25 billion in aggregate principal amount was outstanding under the senior

secured term loan facility, with an approximate fair market value of $1.20 billion.

The senior term loan facility contains financial, affirmative and negative covenants that the Company believes

are usual and customary for a senior secured credit agreement. The negative covenants in the new senior secured

term loan facility include, among other things, limitations (each of which shall be subject to standard and customary

and other exceptions for financings of this type) on its ability to: declare dividends and make other distributions,

redeem or repurchase its capital stock, prepay, redeem or repurchase certain subordinated indebtedness, make loans

or investments (including acquisitions), incur additional indebtedness, grant liens, enter into sale-leaseback

transactions, modify the terms of subordinated debt or certain other material agreements, change its fiscal year,

restrict dividends from our subsidiaries or restrict liens, enter into new lines of business, recapitalize, merge,

consolidate or enter into certain acquisitions, sell our assets, and enter into transactions with its affiliates.

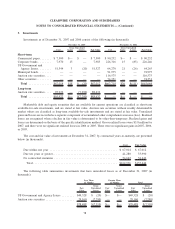

Term Loan — In August 2006, Clearwire signed a loan agreement with Morgan Stanley Senior Funding, Inc.,

Merrill Lynch Capital Corporation, and JP Morgan Chase Bank, N.A. for a term loan in the amount of

$125.0 million. The loan was secured by certain spectrum assets of Clearwire entities, as specified in the loan

agreement. The loan was set to mature in August 2009 and the proceeds of the loan were available for general

corporate purposes. This note was repaid in July 2007 with the proceeds from the Senior-term loan facility.

BCE Nexxia Corporation Financing — As required under the Master Supply Agreement with Bell and BCE

Nexxia and in order to assist funding capital expenses and start-up costs associated with the deployment of VOIP

services, BCE Nexxia agreed to make available to Clearwire financing in the amount of $10.0 million. BCE Nexxia

funded the entire amount on June 7, 2006. The loan is secured by a security interest in the telecommunications

equipment and property related to VoIP and bears interest at 7.00% per annum and is due and payable in full on

July 19, 2008. At December 31, 2007, the Company had $1.2 million of accrued interest related to the BCE Nexxia

loan. The loan balance outstanding as of December 31, 2007 was $10.0 million, with an approximate fair market

value of $9.7 million.

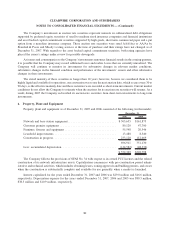

11% Senior Secured Notes due 2010 — In August 2005 the Company completed the sale of $260.3 million in

principal amount of senior secured notes (the “Notes”) due 2010. In connection with the sale of the Notes, the

Company also issued warrants (the “Warrants”) to the purchasers of the Notes entitling them to purchase up to

6,942,552 shares of the Company’s Class A common stock. In addition, the Company granted the purchasers of the

Notes a one-time option to acquire up to an equivalent amount of additional Notes and Warrants for a period of

180 days following the issuance of the Notes. This option was exercised in February 2006 when the Company

completed the sale of $360.4 million senior secured notes to new and existing holders. In connection with the sale of

the additional notes, the Company also issued 9,609,334 Warrants to the purchasers of the additional notes entitling

86

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)