Clearwire 2007 Annual Report Download - page 90

Download and view the complete annual report

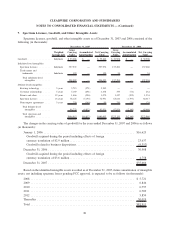

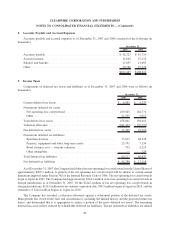

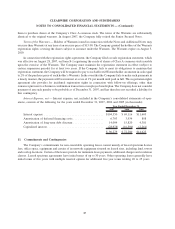

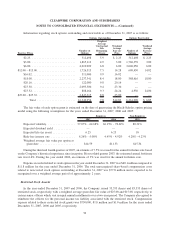

Please find page 90 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Actual amortization expense to be reported in future periods could differ from these estimates as a result of new

intangible asset acquisitions, impairments, changes in useful lives and other relevant factors.

For the years ended December 31, 2007, 2006 and 2005, the Company recorded amortization of $4.4 million,

$2.5 million and $964,000, respectively, on spectrum licenses and other intangibles.

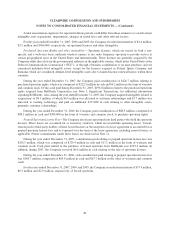

Purchased Spectrum Rights and other intangibles — Spectrum licenses, which are issued on both a site-

specific and a wide-area basis, authorize wireless carriers to use radio frequency spectrum to provide service to

certain geographical areas in the United States and internationally. These licenses are generally acquired by the

Company either directly from the governmental authority in the applicable country, which in the United States is the

Federal Communications Commission (“FCC”), or through a business combination or an asset purchase, and are

considered indefinite-lived intangible assets, except for the licenses acquired in Poland, Spain, Germany and

Romania which are considered definite-lived intangible assets due to limited license renewal history within these

countries.

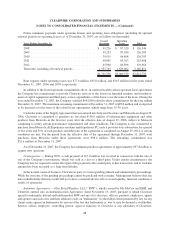

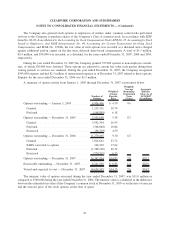

During the year ended December 31, 2007, the Company paid consideration of $226.7 million relating to

purchased spectrum rights, which was comprised of $222.5 million in cash and $4.2 million in the form of warrants

and common stock. Of this cash paid during December 31, 2007, $196.8 million related to the purchased spectrum

rights acquired from BellSouth Corporation (see Note 3, Significant Transactions, for additional information

regarding BellSouth). Also, during the year ended December 31, 2007, the Company acquired intangibles related to

acquisitions of $8.3 million, of which $4.6 million was allocated to customer relationships and $3.7 million was

allocated to existing technology, and paid an additional $373,000 in cash relating to other intangible assets,

primarily customer relationships.

During the year ended December 31, 2006 the Company paid consideration of $88.5 million, comprised of

$88.2 million in cash and $300,000 in the form of warrants and common stock, to purchase spectrum rights.

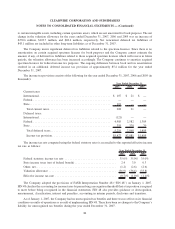

Prepaid Spectrum License Fees -The Company also leases spectrum from third parties who hold the spectrum

licenses. These leases are accounted for as executory contracts, which are treated like operating leases. Consid-

eration paid to third-party holders of these leased licenses at the inception of a lease agreement is accounted for as

prepaid spectrum license fees and is expensed over the term of the lease agreement, including renewal terms, as

applicable. Future commitments under these leases are disclosed in Note 11.

During the year ended December 31, 2007, consideration paid relating to prepaid spectrum license fees was

$256.5 million, which was comprised of $239.4 million in cash and $17.1 million in the form of warrants and

common stock. Cash paid related to the purchase of leased spectrum from BellSouth was $103.2 million. In

addition, during 2007, the Company received $6.0 million in cash relating to the sale of spectrum licenses.

During the year ended December 31, 2006, cash consideration paid relating to prepaid spectrum license fees

was $148.7 million, comprised of $85.0 million in cash and $63.7 million in the value of warrants and common

stock.

For the years ended December 31, 2007, 2006, and 2005, the Company recorded amortization of $37.9 million,

$6.3 million and $2.9 million, respectively, of leased spectrum.

82

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)