Clearwire 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

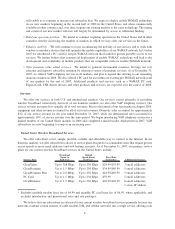

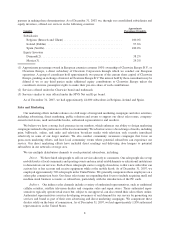

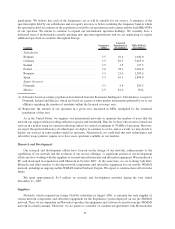

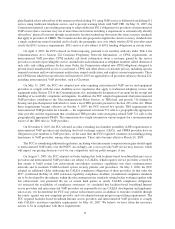

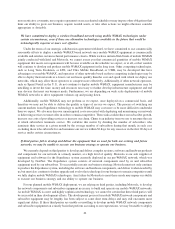

populations. We believe that each of the frequencies are or will be suitable for our service. A summary of the

spectrum rights held by our subsidiaries and our equity investees is below, including the frequency band in which

the spectrum is held, an estimate of the population covered by our spectrum in each country and the total MHz-POPs

of our spectrum. We intend to continue to expand our international spectrum holdings. We currently have a

dedicated team of professionals actively pursuing new spectrum opportunities and we are negotiating to acquire

additional spectrum in countries throughout Europe.

Country

Frequency

(GHz)

Licensed

Population(1)

(In millions)

MHz-POPs(2)

(In millions)

Subsidiaries

Belgium ...................................... 3.5 10.4 1,040.0

Germany ...................................... 3.5 82.5 3,465.0

Ireland ....................................... 3.5 1.5 127.5

Poland ....................................... 3.6 38.1 1,066.8

Romania ...................................... 3.5 21.6 1,209.6

Spain ........................................ 3.5 45.1 1,804.0

Equity Investees

Denmark...................................... 3.5 5.4 205.2

Mexico....................................... 2.5 81.0 N/A

(1) Estimates based on country population data derived from the Economist Intelligence Unit database, except for

Denmark, Ireland and Mexico, which are based on census or other market information gathered by us or our

affiliates regarding the number of residents within the licensed coverage area.

(2) Represents the amount of our spectrum in a given area, measured in MHz, multiplied by the estimated

population of that area.

As in the United States, we engineer our international networks to optimize the number of users that the

network can support while providing sufficient capacity and bandwidth. Thus far we have chosen not to launch our

services in a market using our current technology unless we control a minimum of 30 MHz of spectrum. However,

we expect the spectral efficiency of technologies we deploy to continue to evolve, and as a result, we may decide to

deploy our services in some markets with less spectrum. Alternatively, we could find that new technologies and

subscriber usage patterns require us to have more spectrum available in our markets.

Research and Development

Our research and development efforts have focused on the design of our network, enhancements to the

capabilities of our network and the evolution of our service offerings. A significant portion of our development

efforts involves working with the suppliers of our network infrastructure and subscriber equipment. We introduced a

PC card developed in conjunction with Motorola in October 2007. At the same time, we are working with Intel,

Motorola and other vendors to develop network components and subscriber equipment for our mobile WiMAX

network, including an ongoing mobile WiMAX trial in Portland, Oregon. We expect to continue these efforts in the

future.

We spent approximately $1.4 million on research and development activities during the year ended

December 31, 2007.

Suppliers

Motorola, which acquired our former NextNet subsidiary in August 2006, is currently the only supplier of

certain network components and subscriber equipment for the Expedience system deployed on our pre-WiMAX

network. Thus, we are dependent on Motorola to produce the equipment and software we need for our pre-WiMAX

network in a timely manner. Moreover, we are parties to a number of commercial agreements with Motorola that

13