Clearwire 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

employee termination behavior. If the actual number of forfeitures differs from those estimated by management,

additional adjustments to stock-based compensation expense may be required in future periods.

Valuation of Common Stock

Prior to our initial public offering, members of our management possessing the requisite valuation experience

estimated the fair value of our capital stock in connection with our stock option grants, stock awards, and other

equity based compensation arrangements. We did not obtain contemporaneous valuations prepared by an unrelated

valuation specialist at the time of each stock option issuance because we believe our management possessed the

requisite valuation expertise to prepare a reasonable estimate of the fair value of the interests at the time of each

issuance since inception.

The determination of the fair value of our common stock prior to our initial public offering required

management to make judgments that were complex and inherently subjective. Management used the market

approach to estimate the value of our enterprise at each date options were granted and at each reporting date. Under

the market approach, a transaction-based method was used to estimate the value of our enterprise based on

transactions involving capital stock with unrelated investors and other third parties. This approach assumes that

such transactions constitute the best evidence as to the fair value of our common stock.

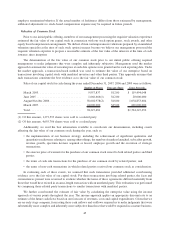

Sales of our capital stock for cash during the years ended December 31, 2007, 2006 and 2005 were as follows:

Number of Shares Price per Share Gross Proceeds

March 2005........................... 9,957,837 $12.00 $ 119,494,048

June 2005 ............................ 1,666,666(1) $12.00 20,000,000

August/October 2006 .................... 58,602,978(2) $18.00 1,054,853,604

March 2007........................... 24,000,000 $25.00 600,000,000

Total ................................ 94,227,481 $1,794,347,652

(1) Of this amount, 1,273,593 shares were sold to a related party.

(2) Of this amount, 4,655,706 shares were sold to a related party.

Additionally, we used the best information available to corroborate our determination, including events

affecting the fair value of our common stock during the year, such as:

• the implementation of our business strategy, including the achievement of significant qualitative and

quantitative milestones relating to, among others things, the number of markets launched, subscriber growth,

revenue growth, spectrum licenses acquired or leased, employee growth and the execution of strategic

transactions;

• the exercise price of warrants for the purchase of our common stock issued to both related parties and third

parties;

• the terms of cash sale transactions for the purchase of our common stock by related parties; and

• the terms of non-cash transactions in which related parties received our common stock as consideration.

In evaluating each of these events, we assumed that such transactions provided additional corroborating

evidence as to the fair value of our capital stock. For those transactions involving related parties, the facts and

circumstances present were reviewed to evaluate whether the terms of these agreements differed materially from

those that would have existed in an arms-length transaction with an unrelated party. This evaluation was performed

by comparing those related party transactions to similar transactions with unrelated parties.

We further corroborated the estimate of fair value by calculating the enterprise value using the income

approach at various points throughout the year. The income approach applies an appropriate discount rate to an

estimate of the future cash flows based on our forecasts of revenues, costs and capital expenditures. Given that we

are an early stage company, forecasting these cash inflows and outflows required us to make judgments that were

substantially more complex and inherently more subjective than those that would be required in a mature business.

45