Clearwire 2007 Annual Report Download - page 51

Download and view the complete annual report

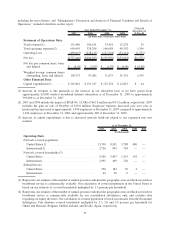

Please find page 51 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fees for software maintenance services were typically billed annually in advance of performance of the

services with provisions for subsequent annual renewals. We deferred the related revenues and recognized them

ratably over the respective maintenance terms, which typically were one to two years.

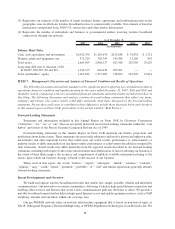

Impairments of Long-lived Assets

We review our long-lived assets to be held and used, including property, plant and equipment and intangible

assets with definite useful lives, for recoverability whenever an event or change in circumstances indicates that the

carrying amount of such long-lived asset or group of long-lived assets may not be recoverable. Such circumstances

include, but are not limited to the following:

• a significant decrease in the market price of the asset;

• a significant change in the extent or manner in which the asset is being used;

• a significant change in the business climate that could affect the value of the asset;

• a current period loss combined with projections of continuing losses associated with use of the asset;

• a significant change in our business or technology strategy, such as a switch to mobile WiMAX wireless

broadband network;

• a significant change in our management’s views of growth rates for our business; and

• a significant change in the anticipated future economic and regulatory conditions and expected techno-

logical availability.

We frequently evaluate whether such events and circumstances have occurred. As our losses to date are a direct

result of expanding our business to support our growth, we have not considered our losses to date as an event that

indicates that the carrying amount of our long-lived assets may not be recoverable. In addition, there have been no

other impairment indicators for any of our asset groups. When such events or circumstances exist, we would

determine the recoverability of the asset’s carrying value by estimating the undiscounted future net cash flows (cash

inflows less associated cash outflows) that are directly associated with and that are expected to arise as a direct result

of the use of the asset. For purposes of recognition and measurement, we group our long-lived assets at the lowest

level for which there are identifiable cash flows that are largely independent of the cash flows of other assets and

liabilities.

If the total of the expected undiscounted future net cash flows is less than the carrying amount of the asset, a

loss, if any, is recognized for the difference between the fair value of the asset and its carrying value.

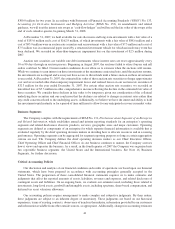

Changes in technology used in our business, such as a transition to mobile WiMAX, may result in an

impairment in the value or a change in the estimated useful life of our Expedience network equipment already

placed in service. If and when such a change occurs, we may be required to record an impairment charge to reduce

the carrying amount of equipment in service to its fair value, and/or to accelerate the useful life of the respective

equipment. This may result in an increase in periodic depreciation expense over the remaining useful life of the

equipment, or, in appropriate instances, a write off of a portion or the entire net book value of the equipment.

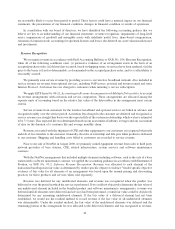

Impairments of Goodwill and Intangible Assets with Indefinite Useful Lives

We assess the impairment of goodwill and intangible assets with indefinite useful lives at least annually, or

whenever an event or change in circumstances indicates that the carrying value of such asset or group of assets may

not be recoverable. Factors we consider important, any of which could trigger an impairment review, include:

• significant underperformance relative to expected historical or projected future operating results;

• significant changes in our use of the acquired assets or the strategy for our overall business; and

• significant negative industry or economic trends.

43