Clearwire 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

including software, such as the sale of a NextNet base station with a software maintenance contract, the Company

applied the accounting guidance in accordance with SOP No. 97-2, Software Revenue Recognition. Revenue was

allocated to each element of the transaction based upon its fair value as determined by vendor specific objective

evidence (“VSOE”). VSOE of fair value for all elements of an arrangement was based upon the normal pricing and

discounting practices for those products and services when sold separately.

Software maintenance services included technical support and the right to receive unspecified upgrades and

enhancements on a when-and-if available basis. Fees for software maintenance services were typically billed

annually in advance of performance of the services with provisions for subsequent annual renewals. The related

revenues were deferred and recognized ratably over the respective maintenance terms, which typically were one to

two years.

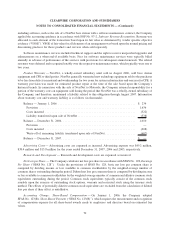

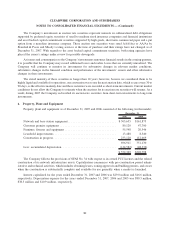

Product Warranty — NextNet, a wholly-owned subsidiary until sold in August 2006, sold base station

equipment and CPE to third parties. NextNet generally warranted new technology equipment sold to the purchaser

to be free from defects in material and workmanship for two years for system infrastructure and one year for CPE. A

warranty provision was made for estimated product repair at the time of the sale based upon the Company’s

historical trends. In connection with the sale of NextNet to Motorola, the Company retained responsibility for a

portion of the warranty costs on equipment sold during the period that NextNet was a wholly-owned subsidiary of

the Company, and therefore, maintained a liability related to this obligation through August 2007. Information

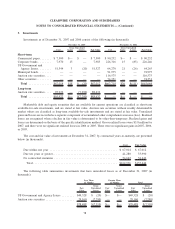

about warranty cost and warranty liability is as follows (in thousands):

Balance — January 1, 2006 ................................................ $ 234

Provision ............................................................ 1,636

Costs incurred ........................................................ (522)

Liability transferred upon sale of NextNet .................................... (338)

Balance — December 31, 2006.............................................. 1,010

Provision ............................................................ —

Costs incurred ........................................................ (408)

Write-off of remaining liability transferred upon sale of NextNet ................... (602)

Balance — December 31, 2007.............................................. $ —

Advertising Costs — Advertising costs are expensed as incurred. Advertising expense was $49.2 million,

$38.4 million and $13.8 million for the years ended December 31, 2007, 2006 and 2005, respectively.

Research and Development — Research and development costs are expensed as incurred.

Net Loss per Share — The Company calculates net loss per share in accordance with SFAS No. 128, Earnings

Per Share (“SFAS No. 128”). Under the provisions of SFAS No. 128, basic net loss per common share is

computed by dividing income or loss available to common stockholders by the weighted-average number of

common shares outstanding during the period. Diluted net loss per common share is computed by dividing income

or loss available to common stockholders by the weighted-average number of common and dilutive common stock

equivalents outstanding during the period. Common stock equivalents typically consist of the common stock

issuable upon the exercise of outstanding stock options, warrants and restricted stock using the treasury stock

method. The effects of potentially dilutive common stock equivalents are excluded from the calculation of diluted

loss per share if their effect is antidilutive.

Accounting Change: Share-Based Compensation — On January 1, 2006, the Company adopted

SFAS No. 123(R), Share-Based Payment (“SFAS No. 123(R)”), which requires the measurement and recognition

of compensation expense for all share-based awards made to employees and directors based on estimated fair

values.

70

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)