Clearwire 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rate of 3.6225% and to receive the three-month LIBOR on a notional value of $300.0 million for three years. The

second swap was entered on January 7, 2008, effective March 5, 2008, to pay a fixed rate of 3.5% and to receive the

three month LIBOR on a notional value of $300.0 million for two years. In accordance with SFAS No. 133, its

amendments and related guidance, the Company will treat the interest rate swaps as “cash-flow hedges” and will

record the fair value of the swaps at the end of each calendar quarter, starting March 31, 2008.

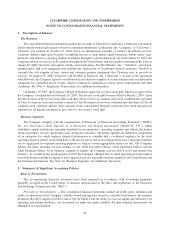

Foreign Currency Exchange Rates

We are exposed to foreign currency exchange rate risk as it relates to our international operations. We currently

do not hedge our currency exchange rate risk and, as such, we are exposed to fluctuations in the value of the

U.S. dollar against other currencies. Our international subsidiaries and equity investees generally use the currency

of the jurisdiction in which they reside, or local currency, as their functional currency. Assets and liabilities are

translated at exchange rates in effect as of the balance sheet date and the resulting translation adjustments are

recorded as a separate component of accumulated other comprehensive income (loss). Income and expense

accounts are translated at the average monthly exchange rates during the reporting period. The effects of changes in

exchange rates between the U.S. Dollar and the currency in which a transaction is denominated are recorded as

foreign currency transaction gains (losses) as a component of net loss. We do not expect the effects of changes in

exchange rates to be material.

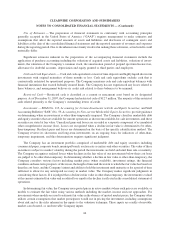

Investment Risk

At December 31, 2007, we held available-for-sale short-term and long-term investments with a fair value of

$155.6 million and a cost of $162.9 million, of which investments with a fair value of $88.6 million and a cost of

$95.9 million were auction rate securities and $67.0 million were government and agency issues, bonds and

commercial paper. We regularly review the carrying value of our short-term and long-term investments and identify

and record losses when events and circumstances indicate that declines in the fair value of such assets below our

accounting basis are other-than-temporary, which we experienced with our auction rate securities during the year

ended December 31, 2007. The fair values of our investments are subject to significant fluctuations due to volatility

of the credit markets in general, company-specific circumstances, and changes in general economic conditions.

Based on the fair value of the auction rate securities we held at December 31, 2007 of $88.6 million, an assumed

15%, 30%, and 50% adverse change to market prices of these securities would result in a corresponding decline in

total fair value of approximately $13.3 million, $26.6 million, or $44.3 million.

Beginning in August 2007, the auctions failed to attract buyers and sell orders could not be filled. Current

market conditions are such that we are unable to estimate when the auctions will resume. While we continue to earn

interest on these investments at the maximum contractual rate, the estimated fair value of these auction rate

securities no longer approximates cost and until the auctions are successful the investments are not liquid. We may

not have access to these funds until a future auction on these investments is successful.

Our investments in auction rate securities represent interests in collateralized debt obligations supported by

preferred equity securities of small to medium sized insurance companies and financial institutions and asset

backed capital commitment securities supported by high grade, short term commercial paper and a put option from

a monoline insurance company. These auction rate securities were rated AAA/Aaa or AA/Aa by Standard & Poors

and Moody’s rating services at the time of purchase and their ratings have not changed as of December 31, 2007.

However, some of the securities remain subject to review for possible downgrade. Any downgrade may result in

further declines in the estimated fair value of the securities as a result of the perceived increase in risk associated

with an investment in the securities.

In addition to the above mentioned securities, the Company holds one commercial paper security issued by a

structured investment vehicle that was placed in receivership in September 2007 for which an insolvency event was

declared by the receiver in October 2007. The Issuer invests in residential and commercial mortgages and other

structured credits including sub-prime mortgages. Based on information received from the receiver, we expect a

restructuring plan for this security to be implemented by mid 2008. This restructuring plan may result in an

additional decline in the estimated fair value of our investments.

58