Clearwire 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

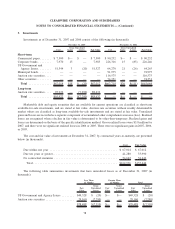

The Company and its Subsidiaries file income tax returns in the U.S. Federal jurisdiction and various state and

foreign jurisdictions. As of the date of adoption of FIN 48 and the year ended December 31, 2007, the tax returns for

2003 through 2006 remain open to examination by the Internal Revenue Service and various state tax authorities. In

addition, the Company has acquired U.S. and foreign entities which operated prior to 2003. Most of the acquired

entities generated losses for income tax purposes and remain open to examination by U.S. and foreign tax

authorities as far back as 1998.

The Company’s policy is to recognize any interest and penalties related to unrecognized tax benefits as a

component of income tax expense. As of the date of adoption of FIN No. 48 and the year ended December 31, 2007,

the Company had accrued no interest or penalties related to uncertain tax positions.

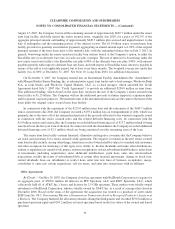

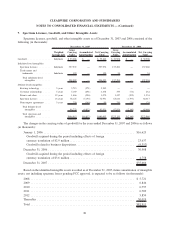

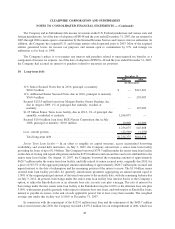

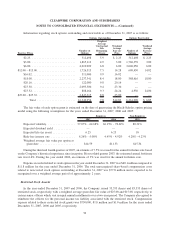

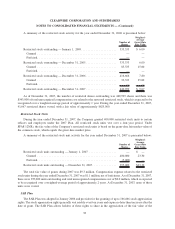

10. Long-term debt

2007 2006

December 31,

(In thousands)

11% Senior Secured Notes due in 2010, principal at maturity:

$260.3 million ........................................... $ — $215,601

11% Additional Senior Secured Notes due in 2010, principal at maturity:

$360.4 million ........................................... — 295,087

Secured $125.0 million loan from Morgan Stanley Senior Funding, Inc.

due in August 2009, 1% of principal due annually; residual at

maturity ................................................ — 125,000

$1.25 billion Senior Term Loan facility, due in 2012, 1% of principal due

annually; resididual at maturity ............................... 1,246,875 —

Secured $10.0 million loan from BCE Nexxia Corporation due in July

2008, principal at maturity: $10.0 million ....................... 10,000 10,000

1,256,875 645,688

Less: current portion......................................... (22,500) (1,250)

Total long-term debt ....................................... $1,234,375 $644,438

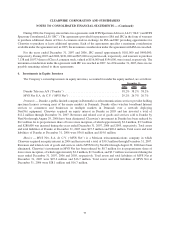

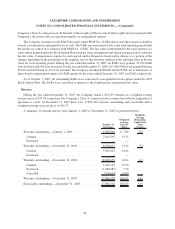

Senior Term Loan facility — In an effort to simplify its capital structure, access incremental borrowing

availability, and extend debt maturities, on July 3, 2007, the Company entered into a senior term loan facility

providing for loans of up to $1.0 billion. The Company borrowed $379.3 million under the senior term loan facility

on the date of closing and repaid obligations under the $125.0 million term loan and fees and costs attributable to the

senior term loan facility. On August 15, 2007, the Company borrowed the remaining amount of approximately

$620.7 million under the senior term loan facility, and fully retired its senior secured notes, originally due 2010, for

a price of 102.5% of the aggregate principal amount outstanding of approximately $620.7 million plus accrued and

unpaid interest to the date of redemption and the remaining portion of the interest escrow. The $1.0 billion senior

secured term loan facility provides for quarterly amortization payments aggregating an annual amount equal to

1.00% of the original principal amount of the term loans prior to the maturity date, with the remaining balance due

on July 3, 2012. In general, borrowings under the senior term loan facility bear interest based, at the Company’s

option, at either the Eurodollar rate or an alternate base rate, in each case plus a margin. The rate of interest for

borrowings under the new senior term loan facility is the Eurodollar rate plus 6.00% or the alternate base rate plus

5.00%, with interest payable quarterly with respect to alternate base rate loans, and with respect to Eurodollar loans,

interest is payable in arrears at the end of each applicable period, but at least every three months. The weighted

average rate under this facility was 11.06% at December 31, 2007.

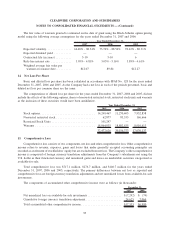

In connection with the repayment of the $125.0 million term loan and the retirement of the $620.7 million

senior secured notes due 2010, the Company recorded a $159.2 million loss on extinguishment of debt, which was

85

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)