Clearwire 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

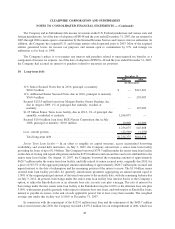

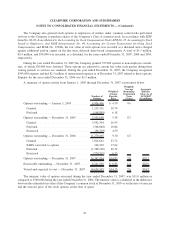

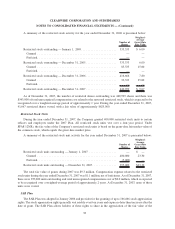

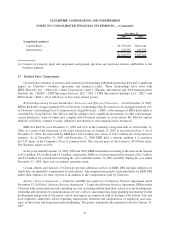

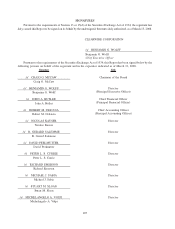

The fair value of warrants granted is estimated on the date of grant using the Black-Scholes option pricing

model using the following average assumptions for the years ended December 31, 2007 and 2006:

2007 2006 2005

Year Ended December 31,

Expected volatility. . . ............. 64.68% - 88.54% 73.76% - 88.54% 78.62% - 80.31%

Expected dividend yield ........... — — —

Contractual life (in years) .......... 5-10 5-10 6

Risk-free interest rate . ............ 3.05% - 4.81% 3.05% - 5.16% 3.89% - 4.61%

Weighted average fair value per

warrant at issuance date .......... $12.07 $9.84 $12.27

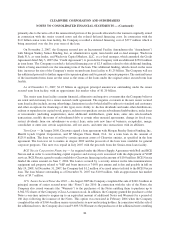

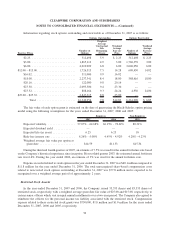

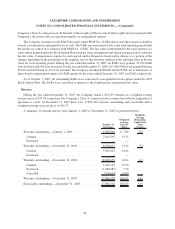

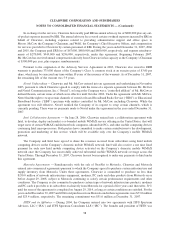

14. Net Loss Per Share

Basic and diluted loss per share has been calculated in accordance with SFAS No. 128 for the years ended

December 31, 2007, 2006 and 2005. As the Company had a net loss in each of the periods presented, basic and

diluted net loss per common share are the same.

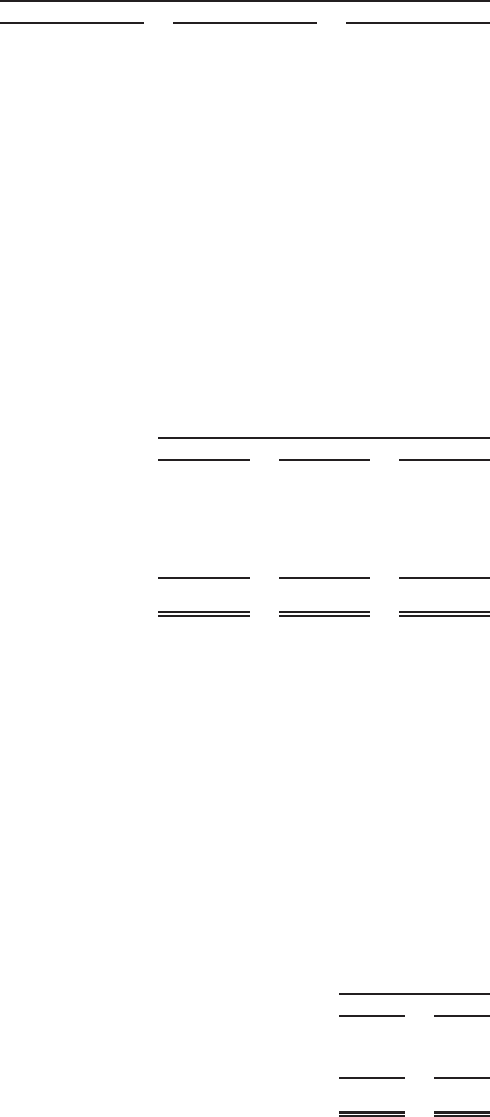

The computations of diluted loss per share for the years ended December 31, 2007, 2006 and 2005, did not

include the effects of the following options, shares of nonvested restricted stock, restricted stock units and warrants

as the inclusion of these securities would have been antidilutive.

2007 2006 2005

Year Ended December 31,

Stock options .................................. 14,249,467 11,270,405 7,952,858

Nonvested restricted stock ........................ 62,877 83,333 166,666

Restricted Stock Units ........................... 101,247 — —

Warrants ..................................... 18,064,035 18,802,635 8,910,613

32,477,626 30,156,373 17,030,137

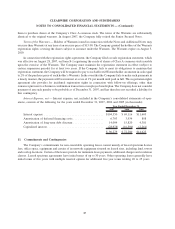

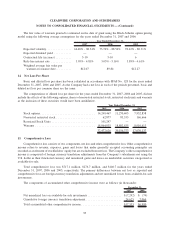

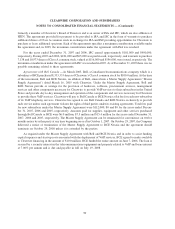

15. Comprehensive Loss

Comprehensive loss consists of two components, net loss and other comprehensive loss. Other comprehensive

income refers to revenue, expenses, gains and losses that under generally accepted accounting principles are

recorded as an element of stockholders’ equity but are excluded from net loss. The Company’s other comprehensive

income is comprised of foreign currency translation adjustments from the Company’s subsidiaries not using the

U.S. dollar as their functional currency and unrealized gains and losses on marketable securities categorized as

available-for-sale.

Total comprehensive loss was $717.1 million, $276.7 million, and $140.7 million for the years ended

December 31, 2007, 2006 and 2005, respectively. The primary differences between net loss as reported and

comprehensive loss are foreign currency translation adjustments and net unrealized losses from available-for-sale

investments.

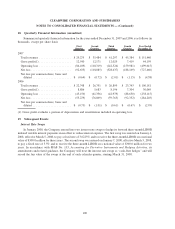

The components of accumulated other comprehensive income were as follows (in thousands):

2007 2006

December 31,

Net unrealized loss on available-for-sale investments ..................... $(7,292) $ (74)

Cumulative foreign currency translation adjustment ...................... 24,625 7,064

Total accumulated other comprehensive income ......................... $17,333 $6,990

95

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)