Clearwire 2007 Annual Report Download - page 48

Download and view the complete annual report

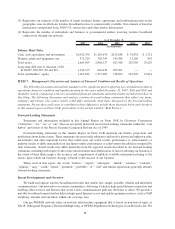

Please find page 48 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.was $1.16 billion, which compares to total assets of $2.07 billion and stockholders’ equity of $1.26 billion at

December 31, 2006. Our unrestricted cash and cash equivalents and unrestricted short-term and long-term

investments were $1.03 billion and $1.10 billion at December 31, 2007 and 2006, respectively. As a consequence

of the particularly turbulent financial markets of late, we cannot offer assurances that the necessary capital to

achieve our current plan will be available on attractive terms or at all, and we plan to manage our use of capital by

adjusting the rate at which we build our network, acquire spectrum and deploy our services.

As we have concentrated our financial and management resources on expanding the geographic footprint of

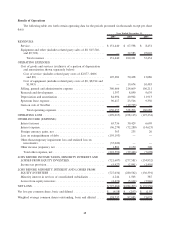

our network and the availability of our services, we have incurred net losses of $727.5 million, $284.2 million and

$140.0 million for the years ended December 31, 2007, 2006 and 2005, respectively.

On May 29, 2007, we closed an agreement with BellSouth Corporation to acquire for an aggregate price of

$300.0 million all interests in SFT Spectrum, LLC and BWC Spectrum, LLC, which collectively held all of AT&T Inc.’s

leases and licenses for 2.5 GHz spectrum. These entities were wholly-owned subsidiaries of BellSouth Corporation,

which is wholly-owned by AT&T, Inc. as a result of a merger that closed in December 2006. Based on the terms of the

agreement, the acquisition was treated as a purchase of assets under Emerging Issues Task Force (“EITF”) Issue No. 98-3,

Determining Whether a Nonmonetary Transaction Involves Receipt of Productive Assets or of a Business.Wefinalized

the allocation estimates during the third quarter of 2007 and recorded $196.8 million as purchased spectrum rights and

$103.2 million as leased spectrum based on the fair values of the owned and leased spectrum.

In an effort to simplify our capital structure, access incremental borrowing availability, and extend our debt

maturities, on July 3, 2007, we entered into a senior term loan facility providing for loans of up to $1.0 billion. We

borrowed $379.3 million under the senior term loan facility on the date of closing and repaid obligations under the

$125.0 million term loan, including fees and costs attributable to the senior term loan facility. On August 15, 2007,

we borrowed the remaining amount of approximately $620.7 million under the senior term loan facility, and fully

retired our senior secured notes, originally due 2010, for a price of 102.5% of the aggregate principal amount

outstanding of approximately $620.7 million plus accrued and unpaid interest to the date of redemption and the

remaining portion of the interest escrow. The $1.0 billion senior secured term loan facility provides for quarterly

amortization payments aggregating an annual amount equal to 1.00% of the original principal amount of the term

loans prior to the maturity date, with the remaining balance due on July 3, 2012. In general, borrowings under the

new senior term loan facility bear interest based, at our option, at either the Eurodollar rate or an alternate base rate,

in each case plus a margin. The rate of interest for borrowings under the new senior term loan facility is the

Eurodollar rate plus 6.00% or the alternate base rate plus 5.00%, with interest payable quarterly with respect to

alternate base rate loans, and with respect to Eurodollar loans, interest is payable in arrears at the end of each

applicable period, but at least every three months. In connection with the repayment of the $125.0 million term loan

and the retirement of the $620.7 million senior secured notes due 2010, we recorded a $159.2 million loss on

extinguishment of debt, which was primarily due to the write-off of the unamortized portion of the proceeds

allocated to the warrants originally issued in connection with the senior secured notes and the related deferred

financing costs. In connection with the $1.0 billion senior term loan facility, we recorded a deferred financing cost

of $27.7 million which is being amortized over the five year term of the loan.

On November 2, 2007, we entered into an Amendment to provide us with an additional $250.0 million in term

loans under our senior term loan facility. We recorded a deferred financing cost of $2.5 million related to this

additional funding, which is being amortized over the remaining term of the loan. This additional funding, which

closed on the same date, increases the size of our senior secured term loan facility to $1.25 billion. We will use the

proceeds to further support our expansion plans and for general corporate purposes. The material terms of the

incremental term loans are the same as the terms of the loans under the original senior term loan facility.

In an effort to reduce interest expense on our senior term loan facility, in January 2008, we entered into two

interest rate swaps to hedge our forward three-month LIBOR indexed variable interest payments. The first swap was

entered on January 4, 2008, effective March 5, 2008, to pay a fixed rate of 3.6225% and to receive the three-month

LIBOR on a notional value of $300.0 million for three years. The second swap was entered on January 7, 2008,

effective March 5, 2008, to pay a fixed rate of 3.5% and to receive the three-month LIBOR on a notional value of

40