Clearwire 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

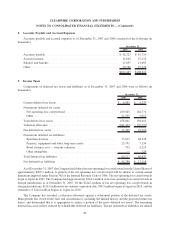

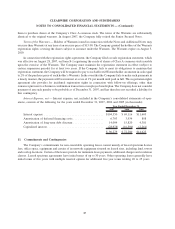

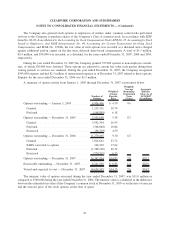

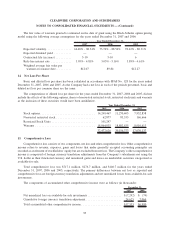

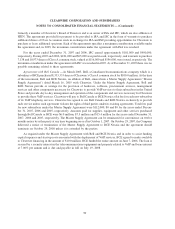

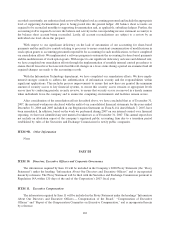

A summary of the restricted stock activity for the year ended December 31, 2006 is presented below:

Number of

Shares

Weighted-

Average

Grant-Date

Fair Value

Restricted stock outstanding — January 1, 2005...................... 333,333 $ 6.00

Granted ................................................. — —

Forfeited................................................. — —

Restricted stock outstanding — December 31, 2005 ................... 333,333 6.00

Granted ................................................. 83,333 15.00

Forfeited................................................. — —

Restricted stock outstanding — December 31, 2006 ................... 416,666 7.80

Granted ................................................. 33,333 25.00

Forfeited................................................. — —

Restricted stock outstanding — December 31, 2007 ................... 449,999 $ 9.07

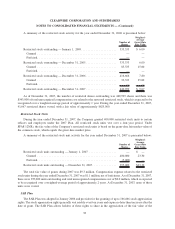

As of December 31, 2007, the number of restricted shares outstanding was 449,999 shares and there was

$543,000 of total unrecognized compensation cost related to the unvested restricted stock, which is expected to be

recognized over a weighted-average period of approximately 1 year. During the year ended December 31, 2007,

41,667 restricted shares vested, with a fair value of approximately $625,000.

Restricted Stock Units

During the year ended December 31, 2007, the Company granted 400,000 restricted stock units to certain

officers and employees under the 2007 Plan. All restricted stock units vest over a four-year period. Under

SFAS 123(R), the fair value of the Company’s restricted stock units is based on the grant-date fair market value of

the common stock, which equals the grant date market price.

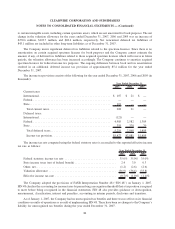

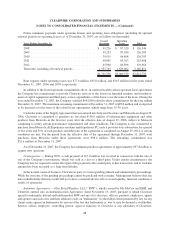

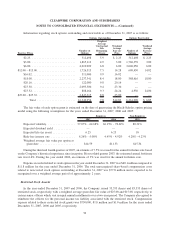

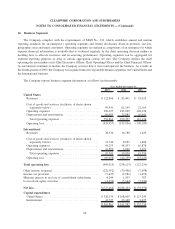

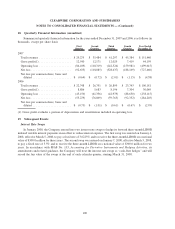

A summary of the restricted stock unit activity for the year ended December 31, 2007 is presented below:

Number of

Shares

Weighted-

Average

Grant-Date

Fair Value

Restricted stock units outstanding — January 1, 2007 ................. — $ —

Granted ................................................. 400,000 23.30

Forfeited................................................. (5,000) —

Restricted stock units outstanding — December 31, 2007 ............... 395,000 $23.30

The total fair value of grants during 2007 was $9.3 million. Compensation expense related to the restricted

stock units during the year ended December 31, 2007 was $1.1 million, net of forfeitures. As of December 31, 2007,

there were 395,000 units outstanding and total unrecognized compensation cost of $8.0 million, which is expected

to be recognized over a weighted-average period of approximately 2 years. At December 31, 2007, none of these

units were vested.

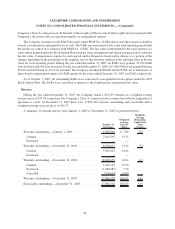

SAR Plan

The SAR Plan was adopted in January 2006 and provides for the granting of up to 166,666 stock appreciation

rights. The stock appreciation rights generally vest ratably over four years and expire no later than ten years after the

date of grant. The SAR Plan allows holders of these rights to share in the appreciation of the fair value of the

93

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)