Clearwire 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

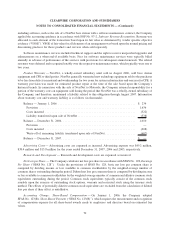

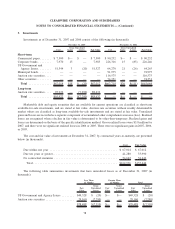

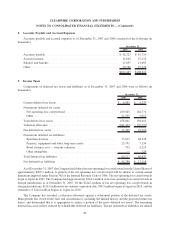

5. Investments

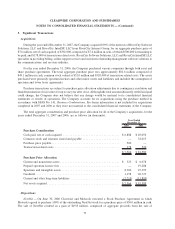

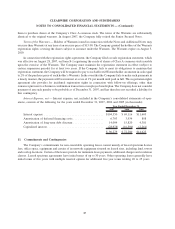

Investments as of December 31, 2007 and 2006 consist of the following (in thousands):

Cost Gains Losses Fair Value Cost Gains Losses Fair Value

Gross Unrealized Gross Unrealized

December 31, 2007 December 31, 2006

Short-term

Commercial paper . ...... $ 7,500 $— $ — $ 7,500 $ 90,232 $— $ — $ 90,232

Corporate bonds ........ 7,970 15 — 7,985 226,316 15 (85) 226,246

US Government and

Agency Issues ........ 51,544 3 (20) 51,527 64,270 21 (26) 64,265

Municipal bonds ........ — — — — 91,975 — — 91,975

Auction rate securities .... — — — — 116,575 — — 116,575

Other securities ......... — — — — 74,351 — — 74,351

Total .............. $67,014 $18 $ (20) $67,012 $663,719 $36 $(111) $663,644

Long-term

Auction rate securities .... 95,922 — (7,290) 88,632 — — — —

Total .............. $95,922 $— $(7,290) $88,632 $ — $— $ — $ —

Marketable debt and equity securities that are available for current operations are classified as short-term

available-for-sale investments, and are stated at fair value. Auction rate securities without readily determinable

market values are classified as long-term available-for-sale investments and are stated at fair value. Unrealized

gains and losses are recorded as a separate component of accumulated other comprehensive income (loss). Realized

losses are recognized when a decline in fair value is determined to be other-than-temporary. Realized gains and

losses are determined on the basis of the specific identification method. Gross realized losses were $5.8 million for

2007, and there were no significant realized losses in 2006 or 2005. There were no significant gains in 2007, 2006,

or 2005.

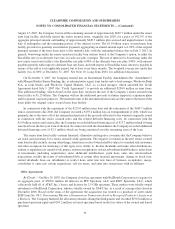

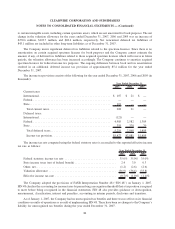

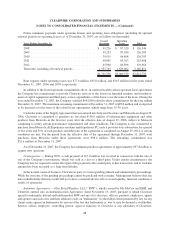

The cost and fair value of investments at December 31, 2007, by contractual years-to-maturity, are presented

below (in thousands):

Cost Fair Value

Due within one year .......................................... $ 67,014 $ 67,012

Due ten years or greater........................................ 41,280 33,990

No contractual maturites ....................................... 54,642 54,642

Total .................................................... $162,936 $155,644

The following table summarizes investments that have unrealized losses as of December 31, 2007 (in

thousands):

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

Less Than

12 Months

Greater Than

12 Months Total

US Government and Agency Issues ........ $49,328 $ (20) $— $— $49,328 $ (20)

Auction rate securities .................. 29,160 (7,290) — — 29,160 (7,290)

$78,488 $(7,310) $— $— $78,488 $(7,310)

78

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)