Clearwire 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

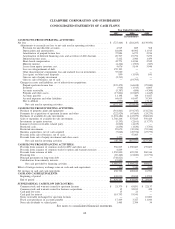

Financing Activities

Net cash provided by financing activities was $1.0 billion for the year ended December 31, 2007 compared to

$1.5 billion for the year ended December 31, 2006. During 2007 our financing activities consisted primarily of cash

proceeds received from the issuance of $1.25 billion in debt and from the $556.0 million net proceeds from our IPO.

This increase in cash received from financing activities was partially offset by principal payments and financing

fees on our senior secured notes and other indebtedness.

Net cash provided by financing activities increased $1.1 billion to $1.5 billion in 2006 from $389.2 million in 2005.

In 2006 we received $1.0 billion of net proceeds from the issuance of common stock, $360.4 million from the issuance of

our senior secured notes, due 2010, and $135.0 million in connection with our commercial loan and other indebtedness.

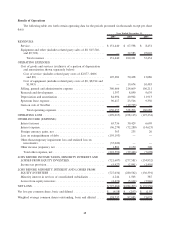

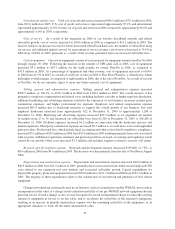

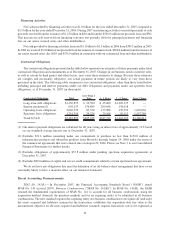

Contractual Obligations

The contractual obligations presented in the table below represent our estimates of future payments under fixed

contractual obligations and commitments as of December 31, 2007. Changes in our business needs or interest rates,

as well as actions by third parties and other factors, may cause these estimates to change. Because these estimates

are complex and necessarily subjective, our actual payments in future periods are likely to vary from those

presented in the table. The following table summarizes our contractual obligations, other than those listed below,

including principal and interest payments under our debt obligations and payments under our spectrum lease

obligations, as of December 31, 2007 (in thousands):

Contractual Obligations Total

Less Than 1

Year 1 - 3 Years 3 - 5 Years Over 5 Years

Long-term debt obligations . . . $1,256,875 $ 22,500 $ 25,000 $1,209,375 $ —

Interest payments(1) ........ 605,153 136,889 269,646 198,618 —

Operating lease obligations . . . 2,060,539 87,320 173,898 170,259 1,629,062

Spectrum lease obligations .... 1,761,256 39,226 79,168 85,113 1,557,749

Total(2)(3)(4).............. $5,683,823 $285,935 $547,712 $1,663,365 $3,186,811

(1) Our interest payment obligations are calculated for all years using an interest rate of approximately 11% based

on our weighted-average interest rate at December 31, 2007.

(2) Excludes $51.6 million remaining under our commitment to purchase no less than $150.0 million of

infrastructure products and subscriber products from Motorola through August 29, 2008 under the terms of

the commercial agreements that were entered into on August 29, 2006. Please see Note 3 to our Consolidated

Financial Statements for further details.

(3) Excludes obligations of approximately $57.8 million under pending spectrum acquisition agreements at

December 31, 2007.

(4) Excludes $89.8 million of capital and service credit commitments related to certain spectrum lease agreements.

We do not have any obligations that meet the definition of an off-balance-sheet arrangement that have or are

reasonably likely to have a material effect on our financial statements.

Recent Accounting Pronouncements

SFAS No. 141(R) — In December 2007, the Financial Accounting Standards Board (“FASB”) issued

SFAS No. 141 (revised 2007), Business Combinations (“SFAS No. 141(R)”). In SFAS No. 141(R), the FASB

retained the fundamental requirements of SFAS No. 141 to account for all business combinations using the

acquisition method (formerly the purchase method) and for an acquiring entity to be identified in all business

combinations. The new standard requires the acquiring entity in a business combination to recognize all (and only)

the assets acquired and liabilities assumed in the transaction; establishes the acquisition-date fair value as the

measurement objective for all assets acquired and liabilities assumed; requires transaction costs to be expensed as

56