Clearwire 2007 Annual Report Download - page 73

Download and view the complete annual report

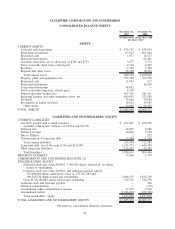

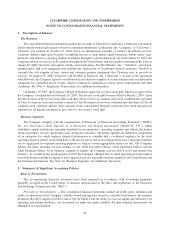

Please find page 73 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Description of Business

The Business

The consolidated financial statements include the accounts of Clearwire Corporation, a Delaware corporation,

and its wholly-owned and majority-owned or controlled subsidiaries (collectively, the “Company” or “Clearwire”).

Clearwire was formed on October 27, 2003 and is an international provider of wireless broadband services.

Clearwire delivers high-speed wireless broadband services to individuals, small businesses, public safety orga-

nizations, and others in a growing number of markets through its advanced network. As of December 31, 2007, the

Company offered its services in 46 markets throughout the United States and four markets internationally. Prior to

August 29, 2006, Clearwire, through its wholly-owned subsidiary, NextNet Wireless, Inc. (“NextNet”), developed,

manufactured, and sold equipment that enabled the deployment of broadband wireless networks. NextNet is

currently the sole supplier of base station and customer premise equipment that Clearwire uses to provide its

services. On August 29, 2006, Clearwire sold NextNet to Motorola, Inc. (“Motorola”). As part of the agreement

with Motorola, the Company agreed to use Motorola as an exclusive supplier of certain infrastructure and subscriber

equipment for a specified period of time, subject to Motorola continuing to satisfy certain requirements and other

conditions. See Note 3, Significant Transactions, for additional information

On January 19, 2007, the Company’s Board of Directors approved a reverse stock split, which was approved by

the Company’s stockholders on February 16, 2007. The reverse stock split became effective March 1, 2007. Upon

the effectiveness of the reverse stock split, each three shares of Class A common stock were combined into one share

of Class A common stock and each three shares of Class B common stock were combined into one share of Class B

common stock. All share and per share amounts in the consolidated financial statements have been retroactively

adjusted for all periods presented to give effect to the reverse stock split.

Business Segments

The Company complies with the requirements of Statement of Financial Accounting Standards (“SFAS”)

No. 131, Disclosures about Segments of an Enterprise and Related Information (“SFAS No. 131”), which

establishes annual and interim reporting standards for an enterprise’s operating segments and related disclosures

about its products, services, geographic areas and major customers. Operating segments are defined as components

of an enterprise for which separate financial information is available that is evaluated regularly by the chief

operating decision makers in deciding how to allocate resources and in assessing performance. Operating segments

can be aggregated for segment reporting purposes so long as certain aggregation criteria are met. The Company

defines the chief operating decision makers as our Chief Executive Officer, Chief Operating Officer and the

Chief Financial Officer. As its business continues to mature, the Company assesses how it views and operates the

business. As a result, in the fourth quarter of 2007 the Company changed how its chief operating decision makers

assess the business and the Company is now organized into two reportable business segments: the United States and

the International business. See Note 16, Business Segments, for additional discussion.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying financial statements have been prepared in accordance with accounting principles

generally accepted in the United States of America and pursuant to the rules and regulations of the Securities

and Exchange Commission (the “SEC”).

Principles of Consolidation — The consolidated financial statements include all of the assets, liabilities and

results of operations of the Company’s wholly-owned and majority-owned or controlled subsidiaries. Investments

in entities that the Company does not control, but for which it has the ability to exercise significant influence over

operating and financial policies, are accounted for under the equity method. All intercompany transactions are

eliminated in consolidation.

65