Blackberry 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

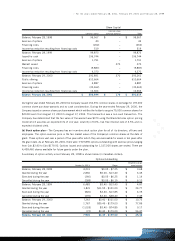

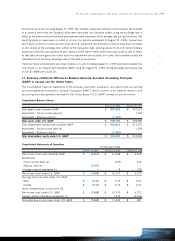

>For the years ended February 28, 2001, February 29, 2000 and February 28, 1999

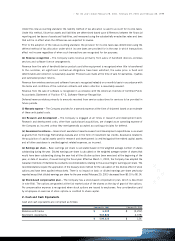

(f) Accounting for stock compensation –Under U.S. GAAP, for any stock option with an exercise price that is

less than the market price on the date of grant, the difference between the exercise price and the market price

on the date of grant is recorded as compensation expense (“intrinsic value based method”). The Company grants

stock options at the fair market value of the shares on the day preceding the date of the grant of the options.

Consequently, no compensation expense is recognized. This method is consistent with U.S. GAAP, APB Opinion

25, Accounting for Stock Issued to Employees.

SFAS No. 123, Accounting for Stock-Based Compensation, requires proforma disclosures of net income and

earnings per share, as if the fair value based method as opposed to the intrinsic value based method of accounting

for employee stock options had been applied. The disclosures in the following table show the Company’s net

income and earnings per share on a proforma basis using the fair value method as determined by using the

Black-Scholes option pricing model include:

For the year ended

February 28, 2001 February 29, 2000 February 28, 1999

Net income (loss) under U.S. GAAP $ (7,568) $ 10,170 $ 6,723

Estimated stock-based compensation costs 11,782 3,261 1,656

Net income (loss) under U.S. GAAP $ (19,350) $ 6,909 $ 5,067

Proforma net income (loss) per common share

Basic $ (0.26) $ 0.10 $ 0.08

Diluted $ (0.26) $ 0.09 $ 0.08

Weighted average number of shares (000’s)

Basic 73,555 66,613 64,148

Diluted 73,555 72,996 66,855

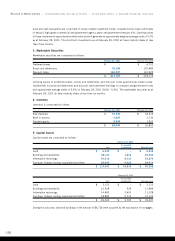

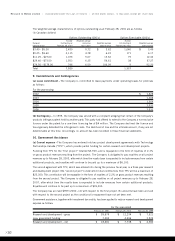

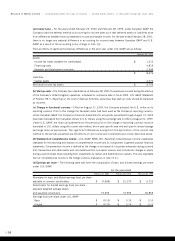

The weighted average fair value of options granted during the following periods were calculated as follows using

the Black-Scholes option pricing model with the following assumptions:

For the year ended

February 28, 2001 February 29, 2000 February 28, 1999

Weighted average Black-Scholes value of options $ 34.82 $ 10.77 $ 1.92

Assumptions:

Risk free interest rates 4% 4% - 5% 4% - 5%

Expected life in years 3.5 3.5 4.0

Expected dividend yield 0% 0% 0%

Volatility 100% 60% - 90% 50%

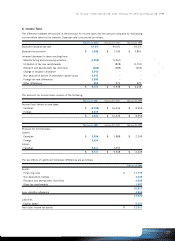

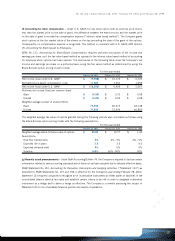

(g) Recently issued pronouncements –Under Staff Accounting Bulletin 74, the Company is required to disclose certain

information related to new accounting standards which have not yet been adopted due to delayed effective dates.

FASB Statement No.133, Accounting for Derivative Instruments and Hedging Activities, (“Statement 133”), as

amended by FASB Statements No. 137 and 138, is effective for the Company’s year ending February 28, 2002.

Statement 133 requires companies to recognize all of its derivative instruments as either assets or liabilities in the

consolidated balance sheet at fair value and establish certain criteria to be met in order to designate a derivative

instrument as a hedge and to deem a hedge as effective. The Company is currently assessing the impact of

Statement 133 on its consolidated financial position and results of operations. >

>35