Blackberry 2001 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

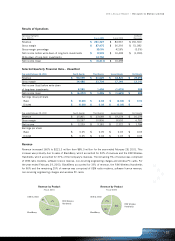

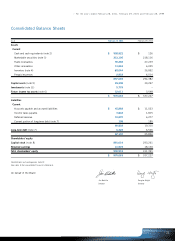

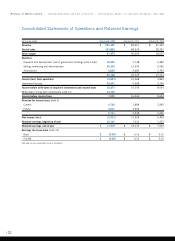

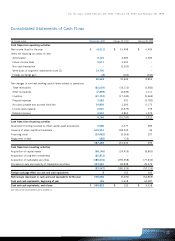

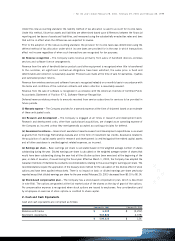

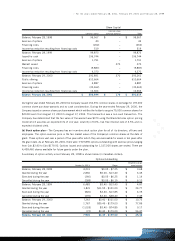

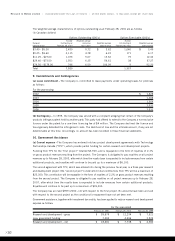

Research In Motion Limited >Incorporated Under the Laws of Ontario >United States dollars, in thousands except per share data

>

Management’s Responsibility for Financial Reporting

To the Shareholders of Research In Motion Limited

The management of Research In Motion Limited is responsible for the preparation of the accompanying financial

statements in accordance with Canadian generally accepted accounting principles, including estimates and

judgements required for such preparation. The financial information appearing throughout this Annual Report is

consistent with the consolidated financial statements.

In fulfilling its responsibility for the reliability and integrity of financial information, management has established and

maintains a system of internal controls and budgeting procedures. Management believes these systems and controls

provide reasonable assurance that assets are safeguarded, transactions are executed in accordance with management’s

authorization and financial records are reliable for the preparation of consolidated financial statements.

The consolidated financial statements are reviewed and approved by the Audit Committee and Board of Directors,

which oversee management’s reporting responsibilities. Zeifman & Company LLP and Ernst & Young LLP, the

independent auditors appointed by the shareholders, have examined the consolidated financial statements in

accordance with Canadian generally accepted auditing standards and their report follows.

The Audit Committee of the Board of Directors, which consists entirely of non-management independent

directors, meets with management and the independent auditors to ensure that each is discharging its respective

responsibilities relating to the financial statements. The external auditors have full and free access to the Audit

Committee to discuss audit findings, financial reporting and other related matters.

Waterloo, Ontario Mike Lazaridis Dennis Kavelman

President & Co-CEO Chief Financial Officer

Auditors’Report

To the Shareholders of Research In Motion Limited

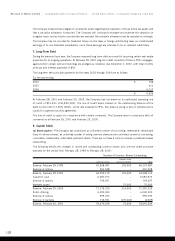

We have audited the consolidated balance sheets of Research In Motion Limited as at February 28, 2001 and

February 29, 2000 and the consolidated statements of operations and retained earnings and cash flows for each of

the years in the three year period ended February 28, 2001. These financial statements are the responsibility of the

Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards

require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are

free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts

and disclosures in the financial statements. An audit also includes assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial

position of the Company as at February 28, 2001 and February 29, 2000 and the results of its operations and

its cash flows for each of the years in the three year period ended February 28, 2001 in accordance with

Canadian generally accepted accounting standards.

As described in note 1(j), effective March 1, 2000 the Company began accounting for income taxes in accordance

with Section 3465 of the Canadian Institute of Chartered Accountants Handbook. In addition, as described in

note 1(o), the Company implemented Section 3500 – Earnings Per Share of the Canadian Institute of Chartered

Accountants Handbook.

Toronto, Ontario Ernst & Young LLP Zeifman & Company LLP

March 30, 2001 Chartered Accountants Chartered Accountants

>20