Blackberry 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

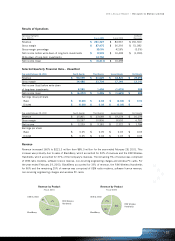

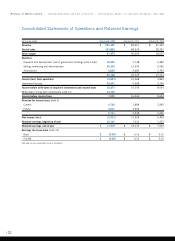

Gross Margin

Gross margins increased to $87.5 million or 39.5% in the fiscal year, compared to $36.4 million or 42.8%

in the previous year. The decrease in gross margin percentage was primarily due to changes in the revenue mix.

Fiscal 2001 included a significantly lower proportion of higher margin items such as software, licence and other

types of non-recurring revenues compared to the previous year. This reduced the consolidated gross margin ratio.

Research and Development

Gross research and development expenditures, primarily composed of salaries for technical personnel, costs of

related engineering materials, software tools and related information technology infrastructure support as well as

subcontracted research and development costs, increased 110% to $25.7 million or 11.6% of revenue in the

year ended February 28, 2001 compared to $12.2 million or 14.4% in the previous year. After accounting for

government funding in the form of expense reimbursements and investment tax credits of $7.4 million for the

current year and $4.5 million in the previous year, net research and development expenditures in fiscal 2001

represented 8.3% of total revenues versus 9.1% in the previous year. The Company benefited from a full year’s

government funding reimbursement with respect to its second of two project development agreements with

Technology Partnerships Canada (“TPC”) in fiscal 2001, versus a partial year in fiscal 2000, as the agreement

with TPC was negotiated and finalized during fiscal 2000.

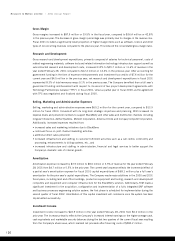

Selling, Marketing and Administrative Expenses

Selling, marketing and administrative expenses were $65.2 million for the current year, compared to $13.9

million for fiscal 2000. Consistent with its long-term strategic objectives and planning, RIM increased its

expense levels and personnel numbers to support BlackBerry and other sales and distribution channels including

Cingular Interactive, Aether Systems, Motient Corporation, America Online and Compaq Computer Corporation.

Additionally, increased expenses resulted from:

•increased sales and marketing initiatives due to BlackBerry

•continued focus on joint channel marketing activities

•additional direct sales personnel

•increased infrastructure and staffing in customer fulfilment activities such as a call centre, order entry and

processing, enhancements to billing systems, etc., and

•increased infrastructure and staffing in administrative, financial and legal services to better support the

Company’s dramatic rate of internal growth.

Amortization

Amortization expense increased by $3.9 million to $8.6 million or 3.9% of revenue for the year ended February

28, 2001 from $4.7 million or 5.5% in the prior year. The current year’s expense reflects the incremental effect of

a partial year’s amortization expense for fiscal 2001 capital expenditures of $68.1 million plus a full year’s

amortization for the prior year’s capital expenditures. The Company made major additions in the 2000 and 2001

fiscal years, including land and office buildings, production equipment and tooling, research and development

computers and equipment and computer infrastructure for the BlackBerry solution. Additionally, RIM made a

significant investment in the acquisition, configuration and implementation of a fully integrated SAP software

and business processes engineering solution system; the first phase is scheduled for implementation during the

second quarter of fiscal 2002. Amortization of this capital investment will commence once the system has been

implemented successfully.

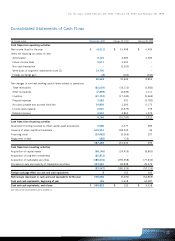

Investment Income

Investment income increased to $22.9 million in the year ended February 28, 2001 from $6.0 million in the

prior year. The increase primarily reflects the Company’s increased interest earnings on the higher average cash,

cash equivalents and marketable security balances during the last two quarters of the current fiscal year resulting

from the Company’s share issue, which realized net proceeds after financing costs of $580.2 million.

>16

Research In Motion Limited >2001 Annual Report