Blackberry 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

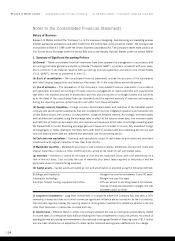

Research In Motion Limited >Incorporated Under the Laws of Ontario >United States dollars, in thousands except per share data

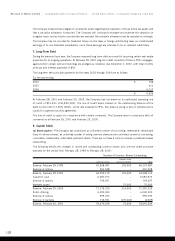

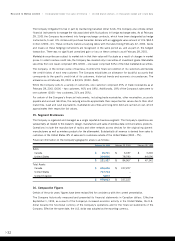

The weighted average characteristics of options outstanding as at February 28, 2001 are as follows

(in Canadian dollars):

Options Outstanding (000’s) Options Exercisable (000’s)

Number Weighted average Number

Range of Outstanding at remaining Weighted average Outstanding at Weighted average

exercise prices February 28, 2001 life in years exercise price February 28, 2001 exercise price

$3.40 - $5.00 2,430 5.72 $ 3.62 1,040 $ 3.45

$5.25 - $9.60 2,115 4.78 6.23 171 6.17

$11.25 - $27.60 1,076 5.07 13.62 79 12.42

$29.40 - $73.50 1,553 6.35 54.61 38 57.27

$74.50 - $179.00 746 6.59 106.09 9 92.20

Total 7,920 1,337

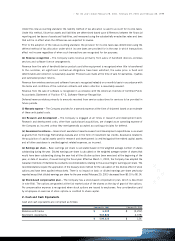

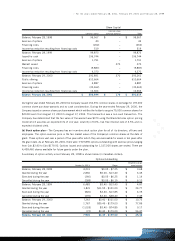

9. Commitments and Contingencies

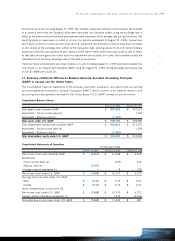

(a) Lease commitment –The Company is committed to lease payments under operating leases for premises

as follows:

For the year ending

2002 $ 1,628

2003 1,488

2004 1,364

2005 1,331

2006 1,331

(b) Contingency –In 1999, the Company was served with a complaint alleging that certain of the Company’s

products infringe a patent held by another party. This party had offered to extend to the Company a non-exclusive

licence under the patent for a one-time licencing fee of $4 million. The Company declined the licence and

has vigorously defended the infringement claim. The likelihood of loss and the ultimate amount, if any, are not

determinable at this time. Accordingly, no amount has been recorded in these financial statements.

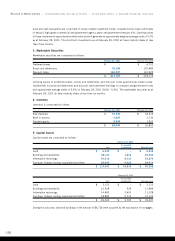

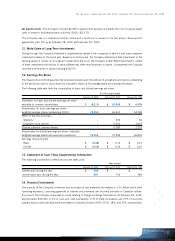

10. Government Assistance

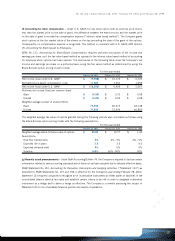

(a) Current expense –The Company has entered into two project development agreements with Technology

Partnerships Canada (“TPC”), which provide partial funding for certain research and development projects.

Funding from TPC for the “first project” totalled $3,900, and is repayable in the form of royalties of 2.2%

on gross product revenues resulting from the project. The Company is obligated to pay royalties on all project

revenues up to February 28, 2003, after which time the royalty base is expanded to include revenues from certain

additional products, and royalties will continue to be paid up to a maximum of $6,100.

The second agreement with TPC, which was entered into during the previous fiscal year, is a three year research

and development project (the “second project”) under which total contributions from TPC will be a maximum of

$23,300. This contribution will be repayable in the form of royalties of 2.2% on gross product revenues resulting

from the second project. The Company is obligated to pay royalties on all project revenues up to February 28,

2007, after which time the royalty base is expanded to include revenues from certain additional products.

Royalties will continue to be paid up to a maximum of $39,300.

The Company has accrued $999 (2000–nil) with respect to the first project. No amounts have been accrued

with respect to the second project as the conditions for repayment have not yet been met.

Government assistance, together with investment tax credits, has been applied to reduce research and development

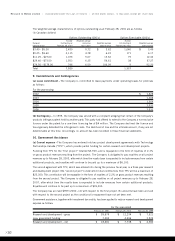

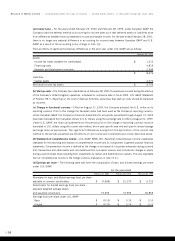

expense as follows:

For the year ended

February 28, 2001 February 29, 2000 February 28, 1999

Research and development – gross $ 25,675 $ 12,234 $ 7,921

Less: government funding 7,394 4,496 3,539

Research and development – net $ 18,281 $ 7,738 $ 4,382

>30