Blackberry 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

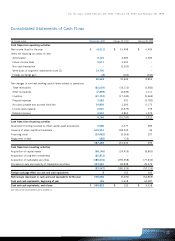

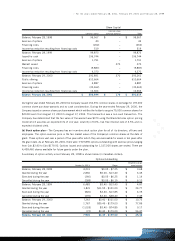

>For the years ended February 28, 2001, February 29, 2000 and February 28, 1999

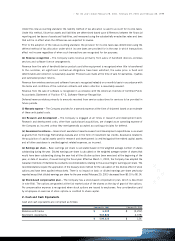

For periods up to and including August 31, 1999, the monetary assets and liabilities of the Company denominated

in a currency other than the Canadian dollar were translated into Canadian dollars using the exchange rate in

effect at the period-end and revenues and expenses were translated at the average rate during the period. Any

resulting gains or losses were included in income. For periods subsequent to August 31, 1999, transactions

which were incurred in currencies other than the U.S. dollar (the new functional currency) have been converted

to U.S. dollars at the exchange rate in effect at the transaction date. Carrying values of non-U.S. dollar monetary

assets and liabilities are adjusted at each balance sheet date to reflect the functional currency rate in effect

at that date and any gains and losses from this restatement are included in income. Non-monetary assets are

translated at the historical exchange rate on the date of acquisition.

Historical financial statements and notes thereto up to and including August 31, 1999 have been restated into

U.S. dollars, in accordance with Canadian GAAP, using the August 31, 1999 closing exchange rate being a rate

of Cdn.$1.4888 per U.S.$1.00.

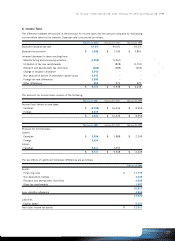

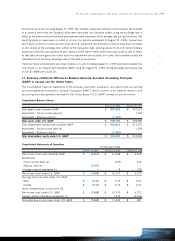

17. Summary of Material Differences Between Generally Accepted Accounting Principles

(GAAP) in Canada and the United States

The consolidated financial statements of the Company have been prepared in accordance with accounting

principles generally accepted in Canada (“Canadian GAAP”) which conform in all material respects with

accounting principles generally accepted in the United States (“U.S. GAAP”) except as set forth below:

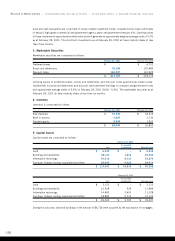

Consolidated Balance Sheets

February 28, 2001 February 29, 2000

Total assets under Canadian GAAP $ 970,063 $ 337,227

Adjustment – Future income taxes (a) –1,158

Adjustment – Start-up costs (b) (1,357) –

Total assets under U.S. GAAP $ 968,706 $ 338,385

Total shareholders’equity under Canadian GAAP $ 902,933 $ 311,391

Adjustment – Future income taxes (a) –1,158

Adjustment – Start-up costs (b) (1,357) –

Total shareholders’equity under U.S. GAAP $ 901,576 $ 312,549

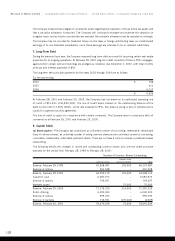

Consolidated Statements of Operations For the year ended

February 28, 2001 February 29, 2000 February 28, 1999

Net income (loss) under Canadian GAAP $ (6,211) $ 10,498 $ 6,409

Adjustments

Future income taxes (a) –(336) 336

Start-up costs (b) (1,357) ––

Foreign currency translation (c) –8 (22)

Net income (loss) under U.S. GAAP $ (7,568) $ 10,170 $ 6,723

Earnings (loss) per share under U.S. GAAP

Basic $ (0.10) $ 0.15 $ 0.10

Diluted $ (0.10) $ 0.14 $ 0.10

Other comprehensive income (loss) (d):

Net income (loss) under U.S. GAAP $ (7,568) $ 10,170 $ 6,723

Foreign currency translation adjustment (c) –1,474 (6,236)

Comprehensive income (loss) under U.S. GAAP $ (7,568) $ 11,644 $ 487

>

>33