Blackberry 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

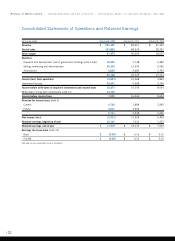

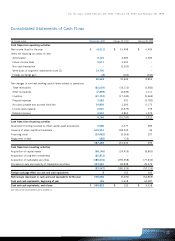

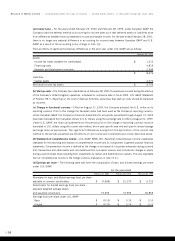

Research In Motion Limited >Incorporated Under the Laws of Ontario >United States dollars, in thousands except per share data

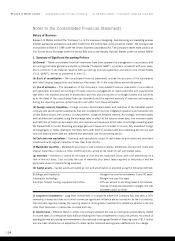

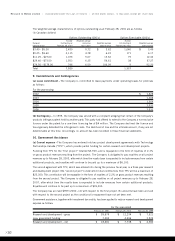

The Company mitigates this risk in part by maintaining Canadian dollar funds. The Company also utilizes certain

financial instruments to manage the risk associated with fluctuations in foreign exchange rates. As at February

28, 2001 the Company has entered into foreign exchange contracts, which have been designated as hedge

instruments, to sell U.S. dollars and purchase Canadian dollars with an aggregate value amount of U.S. $44.5

million (2000–nil). These contracts mature at varying dates with the latest being February 22, 2002. Gains

and losses on these hedging instruments are recognized in the same period as, and as part of, the hedged

transaction. There was no significant unrealized gain or loss on these contracts as at February 28, 2001.

Marketable securities are subject to market risk in that their value will fluctuate as a result of changes in market

prices. In order to reduce credit risk, the Company has invested only in securities of investment grade. Marketable

securities from one issuer comprised 14% (2000 – one issuer comprised 34%) of the total marketable securities.

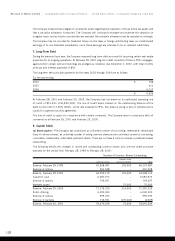

The Company, in the normal course of business, monitors the financial condition of its customers and reviews

the credit history of each new customer. The Company establishes an allowance for doubtful accounts that

corresponds to the specific credit risk of its customers, historical trends and economic circumstances. The

allowance as at February 28, 2001 is $4,976 (2000–$64).

While the Company sells to a variety of customers, one customer comprised 25% of trade receivables as at

February 28, 2001 (2000 – two customers, 46% and 18%). Additionally, 18% of the Company’s sales were to

one customer (2000 – two customers, 31% and 25%).

For certain of the Company’s financial instruments, including trade receivables, other receivables, accounts

payable and accrued liabilities, the carrying amounts approximate their respective fair values due to their short

maturities. Cash and cash equivalents, marketable securities and long-term debt are carried at cost, which

approximates their respective fair values.

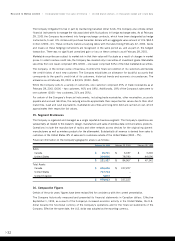

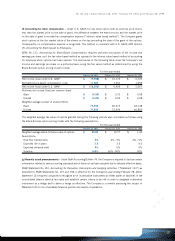

15. Segment Disclosures

The Company is organized and managed as a single reportable business segment. The Company’s operations are

substantially all related to the research, design, manufacture and sales of wireless data communications products.

Operations include the manufacture of radios and other network access devices for the original equipment

manufacturers as well as wireless products for the aftermarket. Substantially all revenue is derived from sales to

customers in the United States. 8% of sales are to customers outside of the United States (2000 –7%).

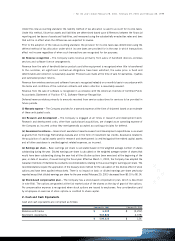

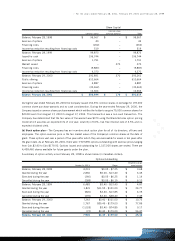

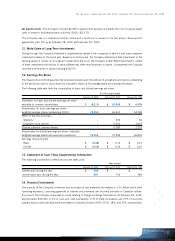

Financial information on the Company’s geographic areas is as follows:

February 28, 2001 February 29, 2000 February 28, 1999

Sales

Canada $ 16,721 $ 6,187 $ 3,246

United States 204,606 78,780 44,096

$ 221,327 $ 84,967 $ 47,342

Total Assets

Canada $ 246,446 $ 337,227

United States 717,744 –

United Kingdom 5,873 –

$ 970,063 $ 337,227

16. Comparative Figures

Certain of the prior years’figures have been reclassified for consistency with the current presentation.

The Company historically measured and presented its financial statements in Canadian dollars. Effective

September 1, 1999, as a result of the Company’s increased economic activity in the United States, the U.S.

dollar became the functional currency of the Company’s operations and for the financial statements of the

Company. Effective the same date, the U.S. dollar was adopted as the reporting currency.

>32