Blackberry 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited >Incorporated Under the Laws of Ontario >United States dollars, in thousands except per share data

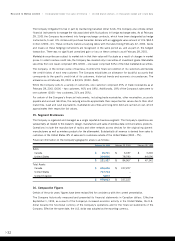

(a) Income taxes –For the years ended February 29, 2000 and February 28, 1999, under Canadian GAAP the

Company used the deferral method of accounting for income taxes such that deferred assets or liabilities arise

from differences between financial statement income and taxable income. For the year ended February 28, 2001,

there is no longer any material difference in accounting for income taxes between Canadian GAAP and U.S.

GAAP as a result of the accounting policy change in note 1(j).

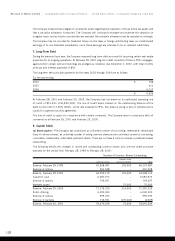

The tax effects of significant temporary differences in the prior year under U.S. GAAP are as follows:

February 29, 2000

Assets

Income tax losses available for carryforward $ 1,212

Financing costs 4,819

Research and development incentives 2,945

$ 8,976

Liabilities

Capital assets 4,270

Net future income tax assets $ 4,706

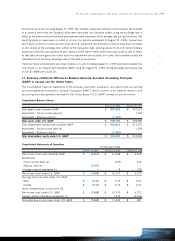

(b) Start-up costs –The Company has capitalized as at February 28, 2001 the expenses incurred during the start-up

of the Company’s United Kingdom operations, scheduled to commence later in fiscal 2002. U.S. GAAP, Statement

of Position 98-5, Reporting on the Cost of Start-up Activities, prescribes that start-up costs should be expensed

as incurred.

(c) Change in functional currency –Effective August 31, 1999, the Company adopted the U.S. dollar as its

reporting currency. Prior to this change the Canadian dollar had been used as the Company’s reporting currency.

Under Canadian GAAP, the Company’s financial statements for all periods presented through August 31, 1999

have been translated from Canadian dollars to U.S. dollars using the exchange rate in effect at August 31, 1999.

Under U.S. GAAP, the financial statements for the periods prior to the change in reporting currency must be

translated to U.S. dollars using the current rate method, which uses specific year end and specific annual average

exchange rates as appropriate. The significant differences arising from the application of the current rate

method to the periods presented are the effects on net income and comprehensive income described above.

(d) Statements of comprehensive income –U.S. GAAP, SFAS 130, Reporting Comprehensive Income, establishes

standards for the reporting and display of comprehensive income and its components in general-purpose financial

statements. Comprehensive income is defined as the change in net assets of a business enterprise during a period

from transactions and other events and circumstances from non-owner sources, and includes all changes in equity

during a period except those resulting from investments by owners and distributions to owners. The only reportable

item of comprehensive income is the foreign currency translation in note 17 (c).

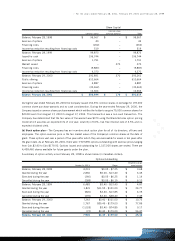

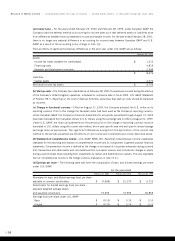

(e) Earnings per share –The following table sets forth the computation of basic and diluted earnings per share

under U.S. GAAP.

For the year ended

February 28, 2001 February 29, 2000 February 28, 1999

Numerator for basic and diluted earnings (loss) per share

available to common stockholders $ (7,568) $ 10,170 $ 6,723

Denominator for diluted earnings (loss) per share –

adjusted weighted average shares

and assumed conversions 73,555 72,996 66,855

Earnings (loss) per share under U.S. GAAP

Basic $ (0.10) $ 0.15 $ 0.10

Diluted $ (0.10) $ 0.14 $ 0.10

>34