Blackberry 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Overview

In fiscal 2001, Research In Motion continued its dramatic growth as an

internationally recognized leader in wireless communications. The BlackBerry

wireless email solution again proved to be a main revenue-driver for RIM,

increasing beyond internal expectations to 54% of revenue in fiscal 2001

versus 19% in the previous year. We anticipate that BlackBerry will continue

to drive the Company’s growth in the future with the development of next-

generation devices and applications.

Tight execution of RIM’s business plan contributed to the success of

fiscal 2001. During fiscal 2001, the Company developed and introduced

BlackBerry Enterprise Edition for Lotus Domino, wireless calendar support

for BlackBerry and the RIM 857 Wireless Handheld.

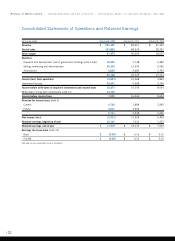

Revenue for the year increased 160% to $221.3 million from $85.0 million in the previous year.

Net income before the write-down of long-term investments (the “write-down”) of $14.8 million decreased to

$8.5 million from $10.5 million. Net loss after the write-down was $6.2 million.

RIM’s revenues are generated through a number of sources. Sales of wireless handhelds to large corporate

customers, strategic partners and network operators continue to yield significant revenue streams for the Company.

Additionally, the Company now earns an increasing amount of its revenues from recurring monthly revenues for

BlackBerry services. Revenues are also generated from:

•sales of enterprise server software and user licences

•sales of radio modems to OEM manufacturers

•non-recurring engineering development services

•software licences.

Sales and marketing channels include direct sales to corporate customers, distribution by network carriers and

Internet service providers and distribution by value-added resellers for the BlackBerry solution.

Basis of Presentation

The Company historically measured and presented its financial statements in Canadian dollars. Effective

September 1, 1999, as a result of the Company’s increased economic activity in the United States (“U.S.”),

the U.S. dollar became the functional currency of the Company’s operations and for the financial statements of

the Company. Effective the same date, the U.S. dollar was adopted as the reporting currency.

For periods up to and including August 31, 1999, the monetary assets and liabilities of the Company denominated

in a currency other than the Canadian dollar were translated into Canadian dollars using the exchange rate in effect

at the period-end and revenues and expenses were translated at the average rate during the period. Any resulting

gains or losses were included in income. For periods subsequent to August 31,1999, foreign currency denominated

assets and liabilities of the Canadian parent company and wholly-owned subsidiaries that are considered to be fully

integrated operations are translated into United States dollars, the currency of measurement, using the temporal

method. Accordingly, monetary assets and liabilities are translated using the exchange rates in effect at the balance

sheet date, non monetary assets and liabilities at historical exchange rates, and revenues and expenses at the rates

of exchange prevailing when the transactions occurred. Resulting exchange gains and losses are included in income.

Any unrealized foreign exchange gains or losses relating to monetary items with fixed or ascertainable lives extending

beyond one year from the balance sheet date are deferred and amortized over the remaining period.

Historical financial statements and notes thereto up to and including August 31,1999 have been restated into

U.S. dollars, in accordance with Canadian GAAP, using the August 31, 1999 closing exchange rate being a rate

of Cdn. $1.4888 per U.S. $1.00.

>14

Dennis Kavelman

Chief Financial Officer

Research In Motion Limited >2001 Annual Report